The $8.9bn listed Evolution Mining is believed to be considering a sale of its Cracow underground gold operation in Queensland.

It is understood to have hired an adviser to test interest in the asset.

It comes as Resolute Mining forges ahead with a plan to sell its Bibiani gold mine in Ghana, West Africa, while Australian-based private equity firm Ibaera Capital, headed by former Fortescue Mentals Group executives, is also exploring a divestment of an African gold mine, Wa-Lawra Gold. Bids are due later this month.

The Cracow mine generates $36m of cashflow annually, producing 80,983 ounces, and is considered one of Evolution’s smaller assets and non-core for the group.

Located 500km northwest of Brisbane, the mine began in 2004 and has a life that stretches out until 2023.

Some say it could be worth at least $100m.

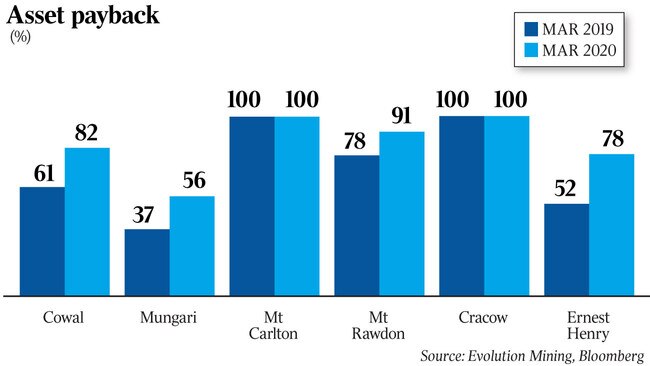

Evolution also owns other smaller mines in Queensland, including Mt Carlton and Mt Rawdon and some market experts suspect that they could also be offloaded.

The company is considered one of Australia’s leading gold producers, and for the 2019 financial year produced 756,001oz of gold at about $924 per ounce.

For the 2020 financial year, Evolution is expected to produce about 725,000oz at an all-in sustaining cost of between $940 and $990 per ounce of gold.

Evolution owns the Cowal gold mine in NSW, the Mungari gold mine in Perth and the Ernest Henry copper and gold mine operated by Glencore.

Last year, it made a $US475m ($700m) purchase of the Red Lake mining complex in Canada from Newmont Goldcorp, with advisory firm Goldman Sachs working on the transaction.

The underground gold mining complex based in Ontario is one of the largest in the world and came after Australian gold miners were said to be exploring acquisition opportunities in Canada, capitalising on strong share prices.

Canadian miners and Australia’s OceanaGold to buy the asset.

Newmont is selling Red Lake after it made a $US10bn acquisition of Goldcorp, which was the world’s fourth-largest producer, but has since become the second-largest producer of the commodity.

Evolution Mining’s executive chairman Jake Klein told investors for the Macquarie Australia Conference it had $330m of net debt and $240m of cash. It reported a $147.2m net profit for the six months to December, up 62 per cent from the previous corresponding period.

Resolute Mining, meanwhile, is working with Treadstone Partners to consider a sale of its Ghana asset which could be worth more than $100m.

The company, which also presented at the Macquarie Australia Conference this week, has hopes to participate in consolidation among African miners in the gold space.

While the Australian listed West African Resources is seen as a logical target, the company is currently thought to be too pricey for the $1bn listed Resolute, given its market value is about $700m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout