Emeco seems to be making fresh efforts to refinance its loans in the offshore debt markets.

The mining services provider’s move to bring forward its full-year results to July 27 has been seen as a sign that a debt refinancing will come sooner rather than later.

When delivering those results, Emeco revealed that it generated $66.1m of net profit for the 2020 financial year, further evidence it has managed to shrug off its troubled past when it came close to collapse because of big debts.

It said it was working towards refinancing $US322m of US notes before the March 31, 2022 deadline and hoped to land a deal by Christmas.

Typically, a company needs to have audited accounts to carry out a refinancing.

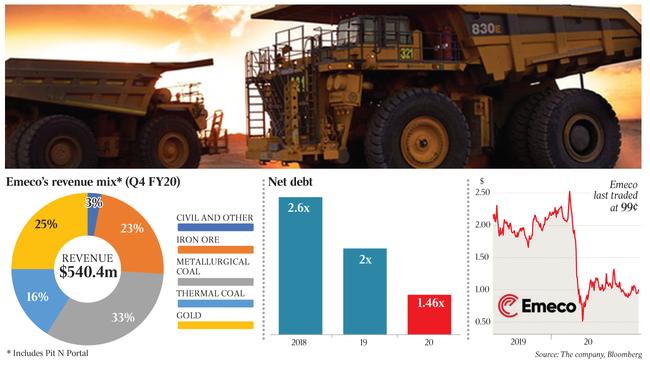

Emeco is trying to source fresh funds for a refinancing, with its total debt levels at $556.8m and cash of $198.2m on its balance sheet.

At the beginning of the year, it moved to tap the Australian bond market for funds to refinance its US debt, but that plan was put on hold when COVID-19 hit the market.

It is understood that the company first approached the US market and wanted to secure about $US300m.

Then it tapped UBS in Australia to secure up to about $350m through its retail broker network.

Documents revealed that retail investors were offered the opportunity to invest in Emeco bonds with a 6.5-7 per cent yield.

Emeco is said to have turned its attention to this market after the bond yields in the US market climbed as high as 9.25 per cent.

Investment bank JPMorgan was handling the US-based raising last time.

About three years ago, Emeco was on the brink of collapse and was subject to a major recapitalisation.

It now counts hedge fund Black Diamond as an 18.65 per cent owner of the stock.

Emeco is the world’s largest independent mining equipment rental business.

Weighing in the company’s favour when it approaches lenders will be the fact that it operates in one of the sectors least affected by the COVID-19 pandemic, with Western Australian mining largely free from the virus and strong demand for some commodities such as gold.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout