Liberty Financial is believed to be revising plans for an initial public offering in a move that could see a handful of major non-bank lenders head to the boards within a year.

Markets sources say the company’s decision-makers had been “dipping their toe back in the water” when it came to a float.

It is understood that Liberty is working with investment bank Credit Suisse on the potential plans, while JPMorgan is known to be close to the business in the past.

Credit Suisse — and also probably rival Liberty Financial management — has held meetings with fund managers in recent days to test appetite for an IPO.

Float intentions have been on-again, off-again with Liberty for some time, and in the latest situation, it is understood that its plans to list rest on a successful IPO of Latitude Financial, which is to head to the boards later this month.

Formed in 1997, Melbourne-based Liberty has grown into one of the nation’s biggest non-bank lenders, offering home, car, business and personal loans.

However, it does not take deposits.

Previously, it was thought to be worth about $1bn.

The non-bank lender was founded by Sherman Ma, who counts himself as executive director, while former Lendlease deputy chairman Richard Longes chairs the company.

Credit Suisse, which Liberty Financial has drafted in as its adviser, is Mr Ma’s former employer.

Born in the US, Mr Ma has featured in BRW rich lists because of his Liberty profits.

For the year to June 30, 2018, Liberty’s profit after tax was $39.98m, slightly higher than the $38.1m it generated in the previous corresponding year, with its total assets increasing to $10bn from $7.38bn, according to company accounts.

The value of loans it wrote increased to $10bn from $7.38bn in fiscal 2017.

Home loans have historically generated more than half of Liberty’s profit.

Should the company head to the boards, it will join mortgage broker Lendi, which has also been sounding out the market.

Working for the online broker are investment banks UBS and Macquarie Capital, which were hired to embark on a private capital deal to secure more than $100m.

One of the major investors was ANZ, which paid a price for an interest that put its value at about $400m, and Macquarie Group is a part owner.

Lendi describes itself as a home loan specialist. It searches products from over 35 lenders.

The business launched in 2013 and has helped Australians settle home loans collectively worth more than $7bn.

Other non-bank lenders expected to head to the boards in the next year are Pepper Australia, which The Australian reported last week is slated for a May listing through Reunion Capital, Citi, Macquarie Capital and Credit Suisse, while non-bank lender Prospa embarked on a float earlier this year.

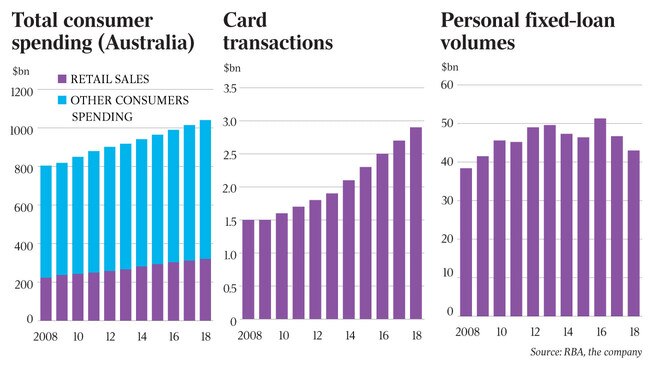

Non-bank lenders are hoping to win more business as Australian banks retreat from some areas of lending due to greater regulation on the back of the royal commission into the banking industry.

The listing plans are unfolding in a low interest rate environment, with Reserve Bank of Australia governor Philip Lowe this month lowering the country’s official cash rate to 0.75 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout