While the Australian pipeline for floats may not be as long and lucrative as it has been in previous years, deals continue to emerge. The latest group to ramp up its initial public offering plans is DDH1 Drilling, backed by private equity firm Oaktree Capital Management.

The group is thought to have hired Bank of America Merrill Lynch for its listing plans, which are expected to happen in the coming months, although the US investment bank did not confirm their recruitment.

It will be interesting to see if Macquarie Capital also features as one of its advisers, given the Australian-based investment bank hosted the business at its dinner showcasing upcoming IPO prospects ahead of its annual investment conference in late April and early May.

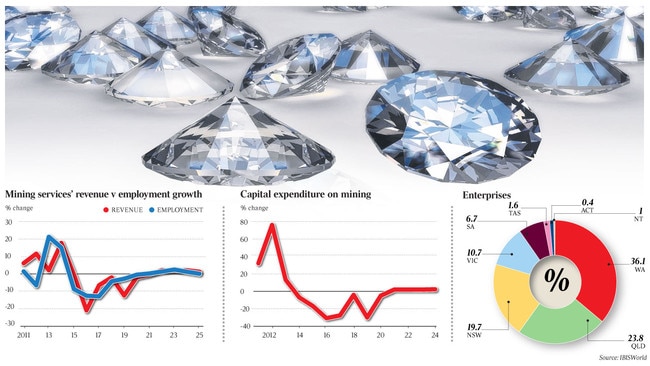

Estimates suggest the business could be worth about $400 million. The float will be a major test of investor appetite for the mining services industry.

No mining services floats have been attempted in Australia for some time and, while the industry has been improving on the back of stronger commodity prices, it remains unclear how eager equity investors will be to pile into a sector that frequently survives on slim margins.

DDH1 is Australia’s largest diamond core drilling contractor, serving the Australian hard rock (non-bulks) minerals industry.

At the Macquarie event, held at the end of April, DDH1 was promoted as a business with the newest and most standardised drilling fleet in Australia. Its diversified customer portfolio includes a number of key, well-capitalised repeat clients.

The expectation is DDH1 will run a dual track process and also test interest for a sale as well as a listing. It will be among a number of services and engineering providers currently on the market, including BGC Contracting, which is up for sale through Macquarie Capital, Fulton Hogan’s Australian operations, which Macquarie is also working on, and the Lendlease engineering and services business that is up for sale through Morgan Stanley and Gresham.

Should a listing proceed successfully, it could be the trigger for services provider to the resources industry, Bis Industries, to try its hand at listing on the local market. Bis tried to float in 2013 as a company worth $1.65 billion, equating to between 10.9-13 times its earnings, but the plans were shelved due to a lack of investor demand.

The company, then owned by Kohlberg Kravis Roberts, later lost the confidence of its lenders as it suffered during the mining downturn about five years ago and was subject to a major recapitalisation.

But as it sought to address its lofty $600m-plus debt pile amid falling earnings, private equity firm The Carlyle Group came to the rescue, acquiring loans in the business along with Varde Partners, Davidson Kepner Capital Management and Metrics Credit Partners.

Most of the original 15-odd lenders later sold out of the syndicate for between 60c and 70c in the dollar.

KKR bought BIS Cleanaway from Brambles for $1.83bn in 2006 and in 2007 it sold the Cleanaway part of the business to Transpacific for $1.25bn.

Other floats currently in the pipeline include the listing of the $2bn Tyro Payments, 15 per cent-owned by Atlassian co-founder Mike Cannon-Brookes and 15 per cent-owned by TDM.

TDM is the private equity firm that floated Baby Bunting and owns a share in Mexican food chain Guzman Y Gomez.

Major investment banks are now preparing to assist in floating the business.

Thought to be well placed are Morgan Stanley and also Goldman Sachs, the US bank that chief executive Robbie Cooke used when he ran gaming company Tatts Group.

Tyro, an EFTPOS payments provider that generates $200m of annual revenue, is expected to list later this year.

The other big listing prospect that may resurface for a float in the last quarter of this year is the $4bn non-bank lender Latitude Financial, although it is understood that no timeline for any IPO has been set.

Dublin-based software development company Fineos will also raise between $150m and $200m when it lists in Australia through Macquarie Capital and Moelis this year.

It is a tech business that analysts estimate is worth between $423m and $493m on an enterprise value-to-earnings basis.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout