The country’s largest healthcare company CSL is one of the businesses benefiting from the global pandemic.

Now the big question is whether it makes use of the billions of dollars added to its market capitalisation by making an acquisition.

Europe has been the traditional hunting ground for the $122.8bn CSL.

With so much spare cash at its disposal, the biotech, which develops and makes products to treat and prevent serious human medical conditions, could easily afford an acquisition north of $10bn.

A deal could spark a major equity raising.

The rule of thumb on major mergers and acquisitions is that the acquirer usually outlays equity amounting to about half of the deal value, which could see CSL tap the market for $5bn.

Previously, CSL is known to have been close to Bank of America, while Goldman Sachs is another logical choice for the biotech.

It has been some time since CSL embarked on any major corporate activity, but a major deal in Europe could bring a hint of nostalgia for chairman Brian McNamee.

Dr McNamee previously ran CSL from 1990 to 2013 and on his watch the company purchased ZLB from the Swiss Red Cross for nearly $1bn, which transformed what was already a large, successful business into a healthcare powerhouse.

CSL’s share price has retreated since the start of the month, leaving some curious about what is happening at the company, with a slump common before a major equity raising.

The company’s share price has staged a steady climb over the past decade and has not broken its stride — it has moved from $150 at the start of 2018 and broke the $200 barrier that year.

CSL is partnering with AstraZeneca in producing a COVID-19 vaccine. It has been moving to deliver it early this year, producing more than 50 million doses at its factory at Melbourne’s Broadmeadows.

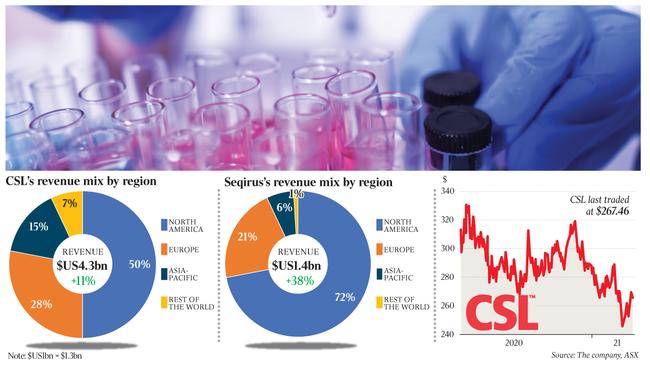

In February, the company delivered a bumper earnings result, with its net profit soaring 44 per cent to $US1.81bn ($2.33bn) in the half-year to December 31, beating analysts’ forecasts.

Revenue surged 18.8 per cent to $US5.6bn.

The result came amid a spike in demand for seasonal influenza vaccines, with CSL’s Seqirus division more than doubling earnings to $US693m, while its core immunoglobulin portfolio continued to perform strongly, led by Hizentra, which reported a 19 per cent sales increase.

The thinking is that if CSL is planning an acquisition, it may target companies in countries such as Germany or Switzerland.

However, plasma companies are not in demand at the moment.

CSL uses human plasma to produce treatments that are used around the world for bleeding disorders including haemophilia and von Willebrand disease, primary immune deficiencies, hereditary angioendema, inherited respiratory disease and neurological disorders.