The $1.7bn listed debt collector Credit Corp is believed to be making attempts to gain control of its struggling rival Pioneer Credit, which remains at the mercy of its lenders.

Shares in Pioneer Credit, which is also listed, have been suspended for some time, with the company on Thursday requesting an extension for the suspension as it delivered an update to its shareholders.

While some distressed debt funds may have been anticipating a recapitalisation of the company, the expectation is now that it will be sold, with various parties in the Azure Capital-run process lining up as suitors.

In an update to the market on Thursday, Pioneer Credit said a group of parties had been short-listed for the final stage of a sales process after it had received a number of indicative proposals, and groups were involved in due diligence.

A preferred bidder is expected to be selected this month.

Pioneer said it was also involved in talks with financing parties in relation to the provision of funding.

However, DataRoom understands that among the shortlisted parties is Credit Corp, while the listed Collection House may also be in the mix.

Pioneer Credit has placed itself up for sale as it remains in talks with its senior lenders, Commonwealth Bank and Westpac, with which it has a standstill agreement. This was after it defaulted on its loans.

The sizeable list of interested parties comes at a time when private equity firms remain eager to snap up distressed assets in the financial space.

Pioneer earlier was in the cross hairs of Bain Capital, so Bain will no doubt also be in the mix.

Shares in the company were initially halted for a long time while it waited for auditors to approve its accounts.

Pioneer Credit describes itself as a company that provides flexible financial services to people in financial difficulty.

It reported its full-year results for the year to June on September 30, saying it had delivered a $4.3m net profit and $63.4m in earnings before interest, tax, depreciation and amortisation, up 17 per cent on the previous corresponding period. At the time, the company’s chairman Michael Smith said the company’s business fundamentals remained strong, despite it breaching its debt covenants.

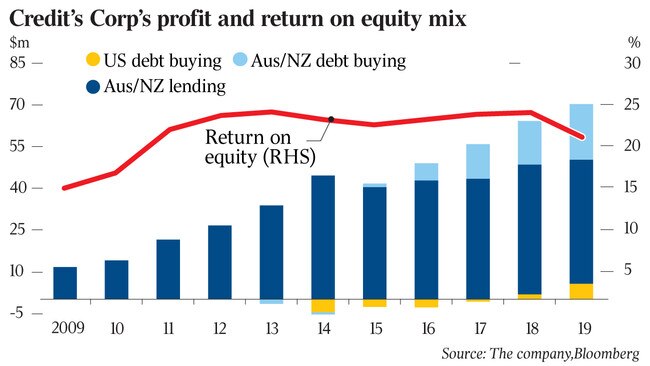

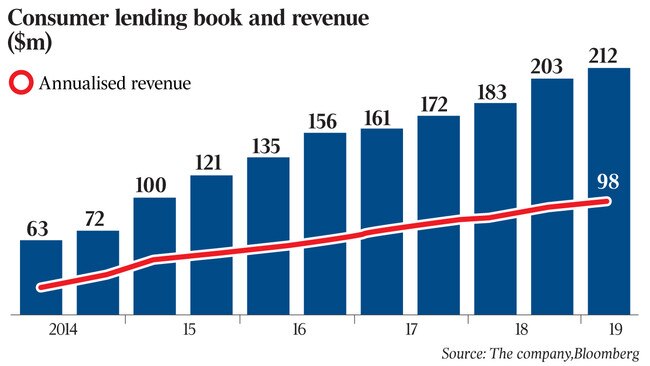

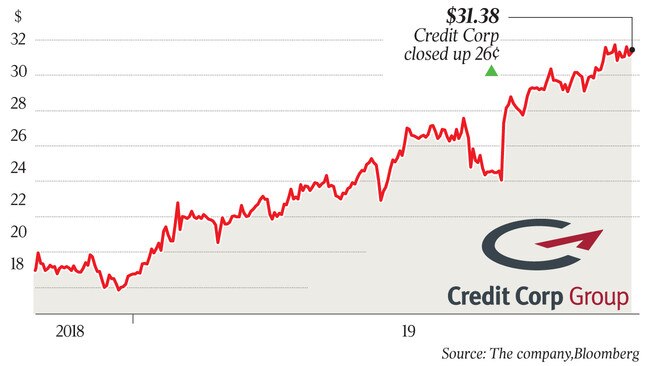

Meanwhile, Credit Corp’s interest in Pioneer Credit comes after the business has recently been on the acquisition trail.

In August, Credit Corp announced the purchase of Australia and New Zealand debt collector Baycorp from Encore Capital Group, in a move that would lift its earnings guidance for the 2020 financial year to see its net profit up 15-18 per cent on the previous corresponding period to $81m-$83m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout