Fund managers and super investors have injected more than $2.5bn into Australian listed companies in the past fortnight to keep them afloat as the economy grapples with the fallout from coronavirus.

The coming week is set to double the figure with Lendlease, Oil Search and Seek all believed to be examining equity raisings to bolster their balance sheets and secure additional liquidity to ride out the virus shutdown.

It is understood that investment banks Goldman Sachs and Morgan Stanley have been sounding out the market to test interest for a potential raising of about $1bn this week for Lendlease.

Construction giant and property investor Lendlease, one of the country’s largest builders and among the largest shopping centre landlords, is currently negotiating over rent, with tenants forced to halt trading amid the COVID-19 shutdowns.

Meanwhile, some property market analysts have raised concerns over whether the Australian company would be hit with financial penalties in the aftermath of the coronavirus crisis if major projects in Milan and London, as well as the US, are delivered late due to shutdowns. Lendlease’s market value has almost halved to about $6bn since the start of March and it is yet to offer any insight into its position since the onset of the coronavirus shutdowns.

Lendlease counts the Melbourne Quarter precinct project on Collins Street and Sydney’s Barangaroo among its largest Australian projects.

There are also suggestions that Oil Search will take advantage of the new rules on placements that give larger companies leeway to raise up to 25 per cent of their market cap in new equity instead of 15 per cent. Sources said Oil Search may tap investors through Goldman Sachs and Macquarie Capital by Wednesday.

Job website Seek may also raise equity following a rapid downturn in job listings.

It is sounding out the h market, while investment bank UBS is working on a potential raising by Tabcorp.

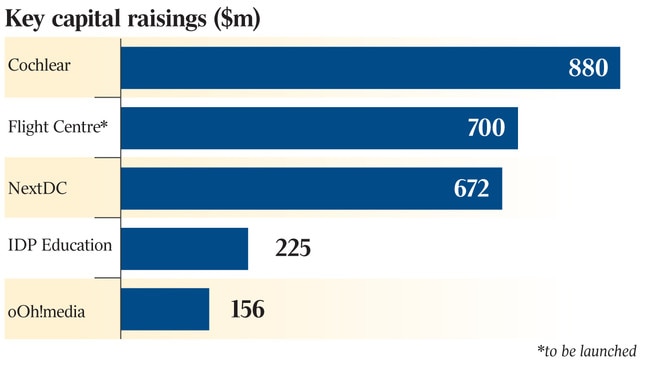

Meanwhile, Flight Centre and Southern Cross Media Group could both be set to move on equity raisings as early as Monday. Flight Centre had initially been looking to raise about $500m but thanks to strong demand at the weekend, this figure is expected to go up to $700m, while Southern Cross Media Group has been seeking to raise about $150m at 8c a share through Macquarie Capital as it fights for survival.

Last week, Webjet locked in $346m through Goldman Sachs, Credit Suisse and Ord Minnett, upsizing its raising on the back of strong demand at a highly discounted $1.70 per share, while IDP Education tapped investors for $190m. Data centre owner Next DC — a beneficiary of the large numbers of people working from home — raised $672m and retailer Kathmandu secured $NZ207m ($202.4m). Also in the past fortnight, blue chip healthcare stock Cochlear secured more than $880m in an equity raising, while oOh!media bought itself more time with its lenders by tapping investors for more than $167m.

Some analysts say the big four banks may soon raise equity to ensure they remain well capitalised.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout