US-based building materials provider Cornerstone Building Brands is shaping up as the frontrunner in the contest to buy Boral’s $2 billion-plus North American operations, according to sources.

Cornerstone is the largest manufacturer of exterior building products in North America, servicing commercial, residential and repair and remodel markets.

The company describes itself as the No.1 manufacturer of vinyl siding, windows and metal accessories as well as metal roofing, wall systems and insulated metal panels.

Based in North Carolina, Cornerstone was created in 2019 through the merger of NCI Building Systems and Ply Gem Parent. One of the group’s backers is the private equity firm Clayton, Dubilier & Rice.

Bank of America has been working on a process to test market interest in the North American operations of Boral at a time when low interest rates are fuelling a housing boom.

It is understood that bids are due in the coming weeks.

While Cornerstone is believed to be showing strong interest, some believe other buyout funds may be shying away, fearing they are not able to compete on price with the private equity giant.

The understanding is that Cornerstone’s interest does not extend to Boral’s North American fly ash division, which is being assessed separately for a potential sale by the Royal Bank of Canada.

Expectations are that Boral would probably want a price of about 10 times earnings before interest, tax, depreciation and amortisation. Boral’s North America division generated $188m in EBITDA for the 2020 financial year.

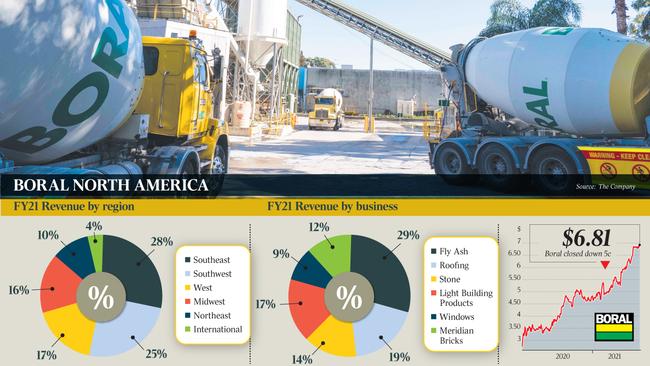

Fly ash accounts for about 30 per cent of its US revenue.

For the first six months of the 2021 financial year, Boral’s EBITDA from its North America arm was $153m.

Cornerstone is believed to be selling its metal panels business and may redeploy the proceeds into exterior building products.

In the US, Boral operates in roofing, light building products, windows, stone and has its Meridian brick venture.

It increased its exposure there after it purchased Headwaters for $3.5bn in 2016, which proved a great disappointment for investors.

Boral is handling US approaches while dealing with a $6.50-per-share takeover bid from the Kerry and Ryan Stokes-led Seven Group, which is looking to increase its stake from 23 to 30 per cent.

Boral’s shares closed at $6.81 on Monday.

Seven’s $7.9bn offer has been rejected by the company while undertaking a share buyback.

However, there is talk in the market that Seven will lift its bid after the current offer expires on June 25, with it so far unable to lift its interest.

Jarden and Citi are working as defence advisers for Boral while Seven has hired Barrenjoey Capital Partners.

The understanding is that Seven is keen for Boral to sell all of its US-based assets and for the company to focus on the Australian market.