Former Myer boss Bernie Brookes is leading a syndicate of investors that are poised to buy the high-profile fashion and accessories chain Colette by Colette Hayman, which collapsed into voluntary administration earlier this year.

It is understood they have exclusive rights until the end of this month to acquire the business after the company’s voluntary administrator, Deloitte, earlier launched a sales process.

Mr Brookes declined to comment.

However, it is understood that the plan for the business involves reducing the company’s bricks-and-mortar retail presence to about 30 stores from more than 100 across Australia and New Zealand.

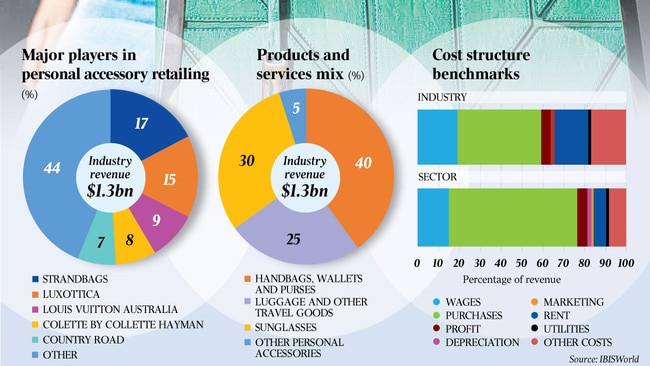

The retailer, which sells fashionable but affordable handbags and jewellery, had an annual turnover of about $100m.

The plan is reduce the business to about a third of the size, with only the most profitable stores remaining in the portfolio.

It is understood Mr Brookes would be both chairman and investor and that he is in the final stages of raising additional funds for the transaction, expected to be worth less than $10m.

Colette was founded in 2010. Three years ago Colette and Mark Hayman sold a 49 per cent stake to the private equity arm of IFM Investors.

At its peak, the chain had about 180 stores, including sites in Britain and South Africa, but that had been steadily reduced to 140, with 126 stores in Australia and 14 in New Zealand. It struggled to secure cash following the Christmas sales. When it collapsed in February, about 150 unsecured creditors were owed about $10m.

Deloitte signalled in February that 33 stores were to close. Later 93 stores that were forced to shut because of the pandemic.

Other collapses this year include Review Clothing and Jets swimwear owner Pas, swimwear brands Seafolly and Tiger Lily, while Jeanswest and Harris Scarfe faltered last year.

The contest to buy Seafolly, meanwhile, narrowed to four bidders last week and an outcome in the KordaMentha-run process is believed to be imminent.

Administrators are expected to offer details in a report to creditors on Monday ahead of the second creditors meeting in a week’s time.

Seafolly stores are still trading, but the company’s Sunburn stores have shut.

Some expect that Seafolly could be broken up, with a party like the Wesfarmers-owned Catch taking the website and a retailer such as Surf, Dive n’ Ski acquiring the right to sell the brands within the stores.

The challenge for Seafolly is that the business is local and highly dependent on the weather.

It was purchased for at least $70m by private equity firm L. Catterton, which initially acquired 70 per cent in 2014, and some believe that the Louis Vuitton-backed Asian private equity firm may be keen to retreat from the Australian market.

L. Catterton had earlier hired Goldman Sachs to sell its other retailer, RM Williams, but a deal never eventuated.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout