Chalice Mining boss Alex Dorsch has confirmed that the company has received approaches from large and mid-cap Australian miners as part of its wide ranging process where it is exploring a full or partial sale.

DataRoom reported last month that Anglo American, South32, BHP and Rio Tinto were expected to be lining up for the $2.3bn nickel explorer and developer.

Sources have said the bid date of the process is August 21, which is still said to remain in the early stages and will likely be finalised by Christmas.

At the Diggers and Dealers Conference in Kalgoorlie on Monday, Mr Dorsch said the process informally started in April.

Offers had come from car and battery makers from North America, Japan, Korea and Europe as well as local mining groups.

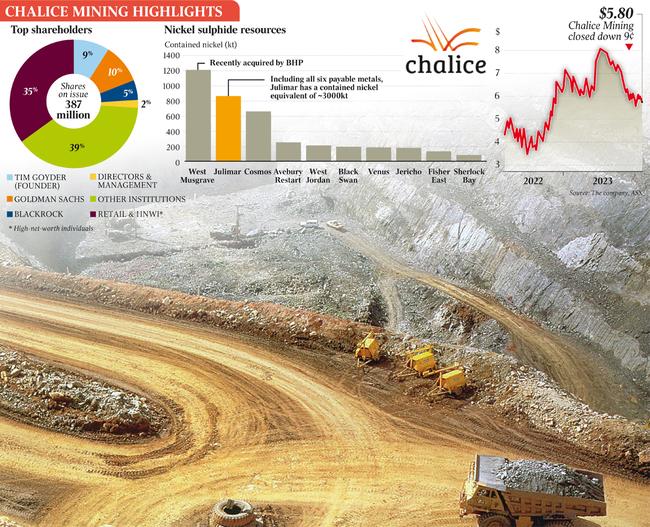

He said the company, which counts well known mining identity Tim Goyder as its 9 per cent shareholder, was open to partnering with more than one party.

“There is room for multiple partnerships,” he said, adding that there was value with a minority partner with an off taker as well as an operator.

The company’s main project is its Julimar nickel and copper project in Western Australia’s Avon region, 70km northeast of Perth and remains up for grabs amid booming demand for battery minerals with the growing move towards electric vehicles.

It is in early exploration phase.

The group’s Gonneville deposit also northeast of Perth in Western Australia is a pre-development project being processed separately and is one of the world’s largest nickel sulphide discoveries.

Chalice reported a net loss of $33.7m for the six months to December and is looking for a backer to fund its development through Standard Chartered.

But some believe the process could result in an acquisition of the company as a whole.

Sources say Chalice is open to several options, including a partial sale of about 20 per cent of the group, or 100 per cent.

Mr Dorsch said the company had deliberately kept the process wide ranging.

He said customers were looking at sourcing more product from Western jurisdictions.