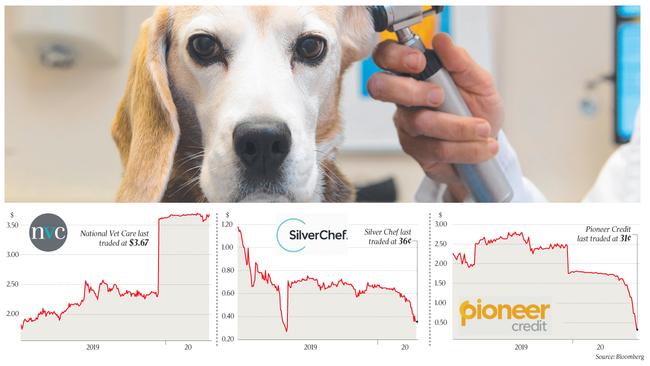

The focus for some private equity firms right now is extracting themselves from deals that have been agreed but not completed, and one example involves the Carlyle Group with its agreed acquisition of listed debt collection business Pioneer Credit.

While Carlyle has already injected debt into the business, it is yet to complete its agreed takeover via a scheme of arrangement. Now it appears to be backing out, telling Pioneer Credit that it wants more information.

Pioneer told the market on Tuesday that Carlyle had asked for more data about Pioneer Credit’s business operations and performance.

Some had questioned whether an acquisition of the listed debt collector by Carlyle could open the door for the global buyout fund to also acquire Pioneer’s troubled listed rival Collection House, but the they say it is not of interest because there were limited synergies between the two businesses.

Carlyle may not the only private equity fund looking to extract itself from agreed deals.

It was only a short time ago that Australian fund BGH Capital agreed to buy dental care provider Abano Healthcare across the Tasman for $300m including debt.

Now, it appears that BGH can extract itself from the deal because the “material adverse change” clauses can be activated, with closures to the dental network for four weeks enforced by the New Zealand government on the back of the coronavirus health crisis.

BGH is yet to make a call on the situation, but most believe private equity firms will be hesitant to complete deals right now when they can walk away and potentially embark on a transaction at a later date and at a cheaper price.

Other agreed takeovers that could still see a suitor walk away include the $250m acquisition by VetPartners — the country’s second largest vet group — of the listed National Veterinary Care.

The deal is dependent on a second court hearing scheduled for Wednesday and will now be held via telephone due to the COVID-19 situation, but the company has not offered any indication that the transaction has been abandoned.

If it completes, it could be the largest deal involving private equity for some time, with the expectation that most — including the opportunistic funds — will sit on the sidelines until there is more certainty surrounding the outlook on possible investments.

Meanwhile, one private equity firm that may be having buyer’s remorse is Next Capital after it spent $18m buying the hospitality business of Silverchef, a lender to the catering and hospitality industry, which has been shut on the back of the coronavirus concerns.

The listed Silverchef, which had been in distress last year, has had its market value almost half since last month to $14m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout