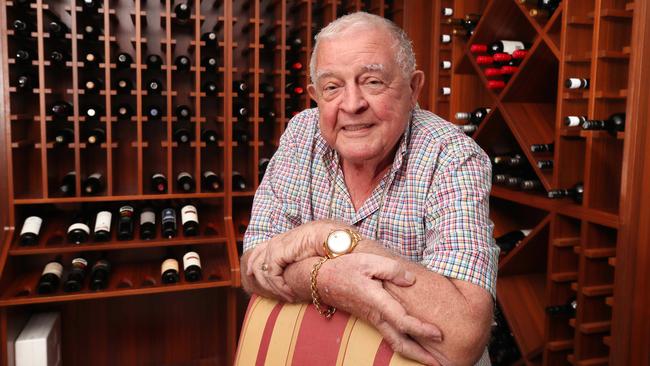

Bruce Mathieson has lifted his holding in Star Entertainment to 8.21 per cent in recent days, but the question on the minds of many is how the company is getting on with it lenders.

It is understood that Star, which reports its results on February 29, has as been in talks with its lender Barclays in recent days.

The suggestion so far is the lender is likely to be supportive, with expectations that the Australian casino operator will keep its licence, despite a string of operational concerns.

Star’s share price is currently 47c and its market value is $1.3bn.

Many have predicted that the play for veteran publican Mathieson is to buy some of the casinos within Star Entertainment’s portfolio, namely those in Sydney or the Gold Coast.

He has made applications to lift his share beyond 10 per cent.

Barrenjoey has advised Star, which raised equity twice last year – first raising $800m then $750m. Net debt last year stood at $596m.

Distressed asset investors that have been around the hoop in the past are Oaktree Capital Management, Bain Capital and Brookfield.

Washington H. Soul Pattinson has also shown interest.

Star Entertainment has been fighting to maintain its casino licences in two states after having been probed by anti-money laundering agency Austrac, and faces hefty fines and expensive undertakings as a result.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout