Canadian private equity giant Brookfield is believed to be among the parties that have taken a look at Sun Cable for a potential acquisition, while Macquarie Asset Management, Iberdrola and Queensland Investment Corporation were all thought to be in the mix.

However, market observers are doubtful that Brookfield will progress in the competition, given it is finalising a deal to buy Origin Energy and will likely make that business its vehicle to capitalise on the transition to renewable energy.

Sources say a deal makes more sense for a party such as Macquarie Asset Management that could make the acquisition work.

While others are all thought to have looked, there’s divided opinion on their level of interest.

QIC, with AGL Energy and its Tilt Renewables operations, and Iberdrola, the world’s largest renewable energy provider recently both lined up to buy CWP Renewables that was purchased by Andrew Forrest’s Squadron Energy.

Some believe that the cable does not make sense for its original purpose of sending renewable power to Singapore and think it will be taken out by original investors.

But others say it is valuable because it could have other purposes such as land use for agriculture and supplying additional power to the domestic market.

There is value in the right to use the land for a special purpose, what with native title, which is where some consider a portion of the value lies and would therefore be value for Andrew Forrest, enabling him to produce hydrogen in Darwin.

Voluntary administrator FTI Consulting said indicative offers had been received for the business from what it says are “multiple parties” and will shortly pull together a short list.

Working on the sale is Moelis, and binding bids are due by the end of April, with a sale expected to be finalised in May.

FTI Consulting has described the short-listed bidders as a range of potential buyers including parties that are not existing Sun Cable shareholders.

Sun Cable is a developer of large-scale renewable energy infrastructure projects, with a significant portfolio of projects and is being promoted in the sale as a complete development.

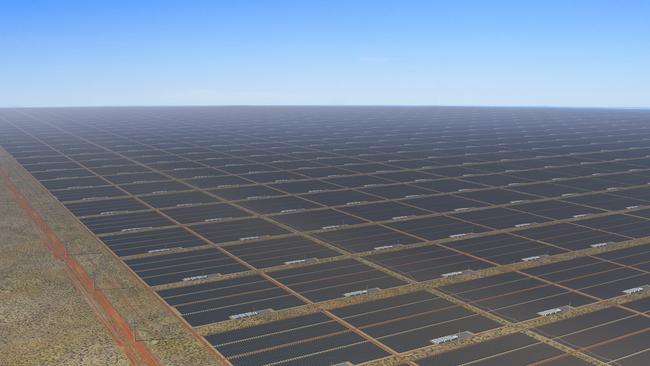

Its primary and most developed project is the world‘s largest solar energy infrastructure network, the Australia-Asia PowerLink (AAPowerLink) in the Northern Territory.

The company collapsed in January.

It came after a rift between its two high profile billionaire backers, Fortescue Metals boss Andrew Forrest and Atlassian co-founder Mike Cannon-Brookes.

It is understood investors had differing views on the cable that would transport energy to the Singapore market via submarine cables and Dr Forrest was keen for the project to be a domestic-focused renewable energy generator.

This caused the project to collapse due to a lack of funding.

The Sun Cable project aimed to send power from Darwin to Singapore via a 4200km electricity cable.

It was planned to transmit 20 gigawatts of power from the world’s largest solar farm near Tennant Creek to Darwin via a 6.4GW, 800km overhead transmission line along with 36-42 gigawatt hours of battery storage.

The first stage of the AA Power Link involves transmitting solar energy around the clock through a high-voltage direct current transmission to Darwin (900MW) and 1.75 GW through high-voltage direct current submarine cables to Singapore.

Stage two would use common infrastructure from stage one to provide further dispatchable renewable energy capacity to Darwin.

FTI Consulting said stage one was materially progressed after gaining a number of the required approvals and being subject to a technical review.

Other investors in the company include Xero founder Craig Winkler, NextDC chief executive Craig Scroggie and Eytan Lenko, chief executive of Boundless Earth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout