Canadian private equity fund Brookfield is understood to have hired PwC to carry out due diligence on a potential acquisition of Sanjeev Gupta’s $1.5 billion-plus steel business InfraBuild.

The understanding is that Brookfield has called on the services of the accounting and insolvency firm as part of a move to weigh up whether to make a potential purchase of Australia’s largest integrated manufacturer and supplier of steel long products like wire, rods rails and bars used in building.

InfraBuild had earlier been earmarked for an initial public offering in Australia later this year and had recently sent out ‘Requests for Proposals’ to appoint advisers for the float.

The company is part of the global steel empire of Mr Gupta’s company GFG Alliance that is said owe at least US$5bn to lender Greensill and has been trying to achieve a temporary standstill on its payments.

DataRoom revealed online on Tuesday that GFG had hired law firm Clayton Utz and insolvency firm EY to provide advice as it wrestles with spectacular collapse of its key financier this week.

Of its debt, about $650m relates directly to InfraBuild and The Australian has reported that Greensill’s administrators InfraBuild’s bond holders could seize InfraBuild entities should standstill talks fail.

It is now understood that the focus of EY’s role is on the InfraBuild arm of Mr Gupta’s operations, but it may extend to involve one more widely across the group, as other rivals also jockey for a position.

InfraBuild, which was previously known as Liberty Steel, owns steel manufacturing mills across Australia.

Part of its portfolio includes two electric arc furnaces with steel production capacity of about 1.5 million metric tonnes per annum and steel distribution centres.

It has more than 5000 staff at more than 200 locations around Australia and also operates in the area of steel recycling.

The interest by Brookfield comes after offshore reports at the start of this month that the Canadian private equity firm had abandoned talks to provide a loan worth hundreds of millions of dollars to a holding company above Mr Gupta’s InfraBuild.

InfraBuild is the strongest performer within Mr Gupta’s global empire at a time that steel prices have been soaring at a sale now could be well timed.

China’s announcement this week that it plans to introduce measures to decrease its pollution levels, which is expected to lead to lower steel production and reduced steel exports and likely to add further fuel to the steel price.

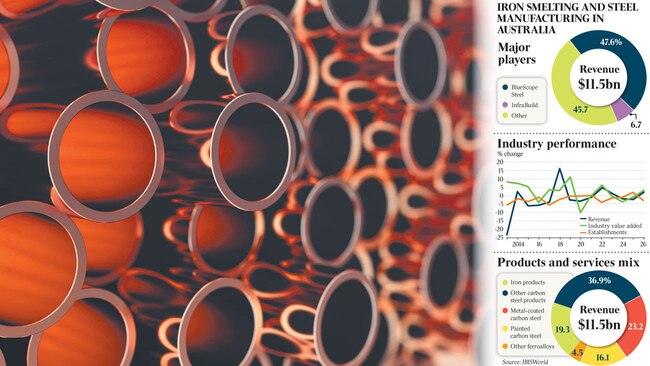

Australian listed rival steel manufacturer Bluescope has been trading at around five year highs.

DataRoom understands that Bluescope is not an interested buyer of InfraBuild.

Brookfield, with assets under management of more than US$510.6 billion, is understood to be familiar with the company after looking at its assets when they were part of the Arrium empire that collapsed in 2016.

Much of Arrium’s undoing was thought to be related to the troubled Whyalla Steelworks in South Australia, held separately to InfraBuild.

Mr Gupta has recently sought state government assistance with Whyalla’s financial challenges.

Some say that KordaMentha is likely to emerge as an adviser to the South Australian government surrounding Whyalla or the unions, where it has strong ties.

The firm worked on the restructure of Arrium that ended with a purchase by the steel assets, iron ore mines and Whyalla Port and Rail by Mr Gupta for about $700m in 2017.

It is understood that efforts by Mr Gupta to find a buyer of the port following talks with investment banking advisers have proved unsuccessful.

Meanwhile, Brookfield could be well placed to buy InfraBuild as Chinese firms retreat from the market due to greater challenges gaining approval for acquisitions from the Foreign Investment Review Board.

GFG Alliance is understood to have a range of debt facilities at different levels, including a number of non-bank lenders, including trade financiers that fits the description of those like Affinity Equity Partners’ Scottish Pacific.

However, Scottish Pacific says it is not a lender to GFG Alliance.

.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout