Private equity powerhouse Brookfield is set to continue its spending spree in Australia after walking away from AGL Energy for now, with sources suggesting the $1bn-plus RetireAustralia is firmly within its sights.

Brookfield and Australian tech billionaire Mike Cannon-Brookes made a second bid for AGL at the weekend, but their higher $8.25 per share offer was rejected and the pair said they were walking away.

Yet Brookfield has not yet declared the offer its best and final. While the buyout fund has said it is “pens down” for now, it can return at any stage with another bid should it choose.

The Takeover Panel rules prevent a bidder from improving or extending a bid for four to six months after it has declared it ‘‘best and final’’.

The latest offer, valuing the company at $5.4bn excluding debt, came after its earlier $7.50 per share bid, which was only a 4.7 per cent premium to the last closing price.

Some suspect that after telling the market that they were walking away, with Brookfield and Mr Cannon-Brookes may have hoped that shares in AGL would tumble, which could provide a better opportunity for them to renegotiate at another stage.

However, shares only fell 1.75 per cent or 13c to $7.30 per share in a market that was a sea of red on Monday.

The ASX 200 closed down 1 per cent.

Meanwhile, Brookfield – one of the most prolific deal-makers in Australia in the past year – is also said to have its eye on RetireAustralia as it considers a sale.

Australian operator Aveo sold its retirement business to Brookfield in 2019 for $1.9bn.

Sources believe that RetireAustralia’s price aspirations are high, and if it sells on a similar multiple to that seen in the sale of Stockland’s Retirement Living unit to EQT Infrastructure last month, the price tag will be more than $1bn.

Brookfield was the underbidder in the recent Stockland Retirement Living auction, along with Blackstone and Kohlberg Kravis Roberts.

EQT paid $987m for Stockland’s business.

RetireAustralia’s owners, Infratil and NZ Super Fund, are understood to have been contemplating a sale of the business for a while.

The business is the fifth-largest Australian retirement village service provider behind Lend Lease, Stockland, Aveo and Retirement Villages Group.

It owns and operates 28 retirement villages across Australia along with a development pipeline.

JPMorgan and Morgan Stanley special situation funds sold RetireAustralia (then Meridien) after they recapitalised it following challenges during the GFC more than a decade ago.

Brookfield has been on a major acquisition spree in Australia, buying energy company Ausnet for $10bn and half of smart metering company Intellihub for $1bn. It is also understood to have looked at Origin Energy and other targets.

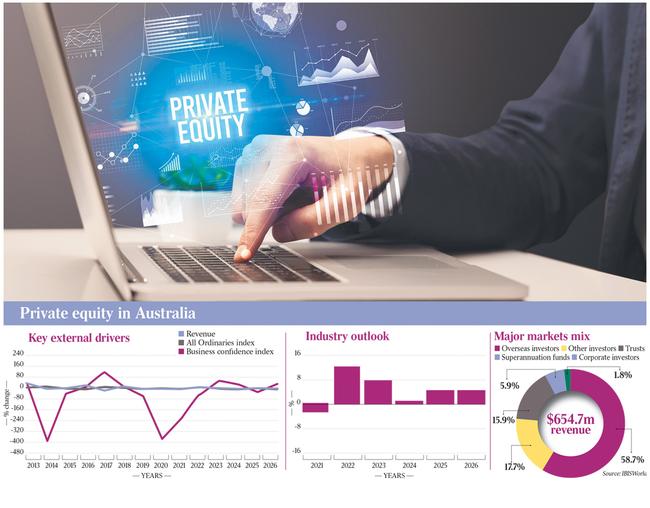

Private equity firms have been cashed-up and ready to spend in Australia in the past year, with low interest rates and record raisings for funds.

Private equity firms are scouring the lists of their fund investors to ensure they don’t run afoul of new sanctions against Russian oligarchs, according to the Wall Street Journal. The new sanctions represent a significant challenge for smaller firms, the Journal says, adding that identifying sanctions for targets can be tricky.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout