There’s a buzz building around the market about the $364m Brazilian Rare Earths, with suggestions its rare earths deposit is the highest grade globally.

Petra Capital has initiated coverage on the stock after it announced what it describes as “super high-grade drill results” last week, causing its share price to rally.

While the evidence is coming through now, mining insiders always had high hopes for the rare earths explorer, with Gina Rinehart’s Hancock Prospecting and Whitehaven Coal joining the register in a pre-IPO round some years back.

It listed in December, raising $50m in its initial public offering with shares offered at $1.47, soaring to $1.60 on the first day.

They are currently at about $1.70.

Over the first ten drill holes into its high-grade zone at its flagship Monte Alto project, Brazilian Rare Earths intersected an average grade of 17.6 per cent of Total Rare Earth Oxides across an average true width of 6m and up to 17.6m.

Petra Capital says that for context, Lynas has a reserve grade of 8 per cent.

“We expect Brazilian Rare Earth’s market cap to increase as investors become aware of what could be the highest grade rare-earth project globally, with sector wide ramifications.”

The company has built up a 1,683 square kilometre tenement package and established a large 510 mega tonne rare earth resource.

Petra Capital says the resource is primarily iconic clay, but the analysts said that they were only forecasting production from the mineralisation of the mineral monazite, which would grow in future updates following the strong results this month.

The analysts point out that Brazilian Rare Earths is well funded, with $50m of cash to pursue its exploration strategy.

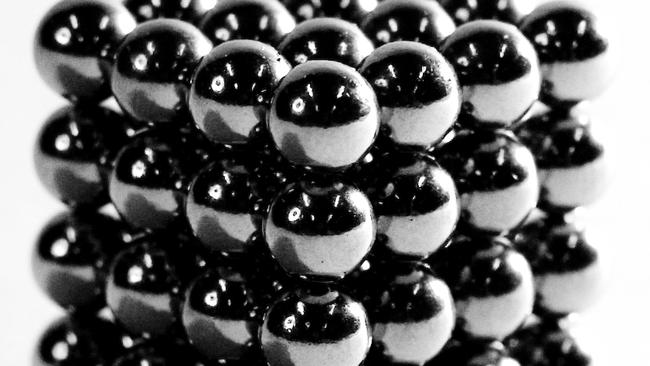

The analysts believe that although in the early stage, they assume a stage two development with initial production of 4.4 thousand tonnes per annum of neodymium and praseodymium, key minerals used in ultra-strong magnets, needed for electronics, technology and automotive industries.

They forecast a $509m net present value for the stage one monazite project, but calculate a$2.3bn net present value for the higher-grade stage two project development.

Market experts say the rise of Brazil Rare Earths comes amid a ground swell of interesting project out of the South American nation at a time that battery metals are heavily sought after amid the transition to renewable energy.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout