Block trade looms for $4bn Ramsay Health Care stake

The Paul Ramsay Foundation’s $4 billion-odd stake in Ramsay Health Care is currently a talking point among equity capital markets bankers, with speculation mounting that it could be subject to a lucrative block trade sooner rather than later.

Some believe that Goldman Sachs is close to the action and could be mandated on any transaction.

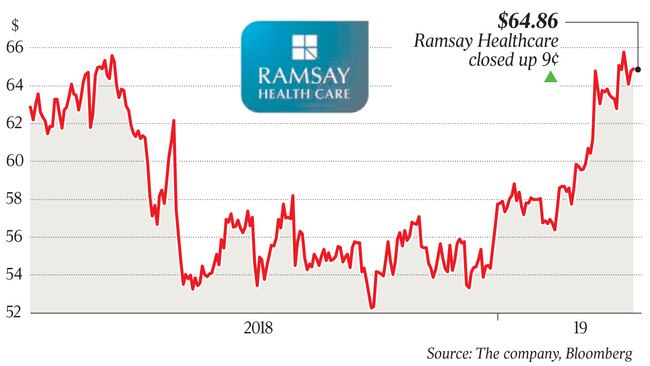

Shares in Ramsay are riding high, closing at $64.86 on Friday after trading around $55 only six months ago.

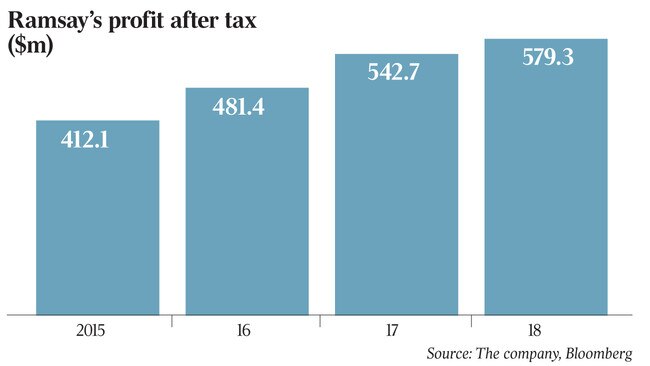

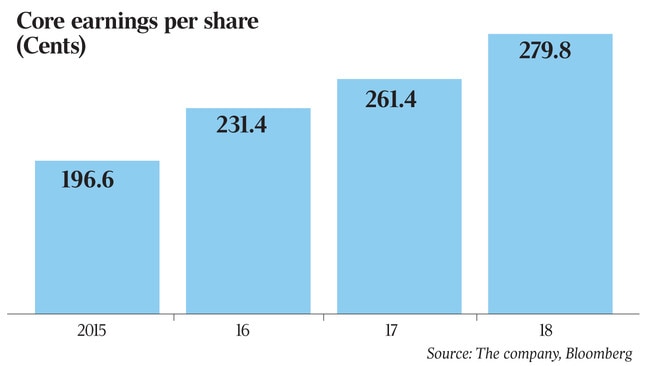

The country’s largest private hospital operator also recently held strategy days in London and Stockholm as part of its recent marketing efforts after posting an interim 9.6 per cent lift in its net profit to $270.1 million.

Some consider the investor briefings as cleansing events in terms of releasing all information to the market, including some previously not disclosed, so that a major trade can occur.

The Paul Ramsay Foundation inherited a major interest in Ramsay Health Care following the death of its founder Paul Ramsay in 2014.

At that time, the foundation, which supports charitable causes in Australia, aiming to identify the root causes of disadvantage, held about 36 per cent of the company.

However, it has already sold down some of its interest.

In 2014, it divested about 2.2 per cent of its shares, worth $224.4m.

At that time, the trade was handled through Deutsche Bank, with the company said to be close to Hong Kong-based banker James McMurdo, who previously worked at Goldman Sachs.

One school of thought is that the company could divest half of its interest, which would release about $2bn worth of cash.

This could be used to invest elsewhere as part of an diversification plan.

When the foundation secured the stake it was thought to be worth about $3.3bn but it is now worth closer to $4bn.

Should the foundation part with half of its stake, it would be the largest block trade since Woodside Petroleum sold out of Shell in 2017.

It comes as the equity capital market remains relatively quiet on the initial public offering front.

One of the only floats hitting the market in the coming weeks is that of software company ReadyTech, owned by Pemba Capital.

Apparently demand remains strong for the business at a time when fund managers search for limited opportunities and the technology space remains in favour.

While the deal remains in demand and analysts believe shares will be sold, the question is at what price.

The group is looking at a price between $1.90 and $2.54.

The non-bank lender Prospa has also recently been carrying out investor meetings ahead of a float.

Elsewhere, Macquarie’s infrastructure arm MIRA is understood to have hired Credit Suisse to sell Hobart Airport.

A sale of the Tasmanian asset has been on the cards for some time.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout