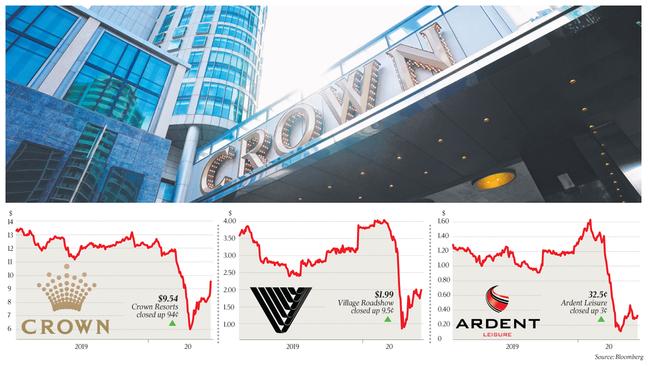

Blackstone’s $552m acquisition of a 9.99 per cent stake in Crown Resorts from Lawrence Ho is the latest case of private equity firms shifting focus from takeovers to opportunistic equity injections amid the current stage of the coronavirus crisis.

The question remains: what group is the next target?

Like Blackstone, Bain Capital has bought shares in a company suffering from COVID-19 distress, outlaying funds for a small stake in online travel agency Webjet.

Opportunistic buyout groups have also circled the listed Southern Cross Media, along with billboard operator oOh!media.

Flight Centre has had the Certares fund around the hoop.

Now some are wondering whether Village Roadshow could have received approaches for a cash injection from private equity.

The cinema and theme park operator had been subject to two private equity approaches before the COVID-19 problems arose, with Australian funds BGH Capital and Pacific Equity Partners both offering between $750m and $800m for the business.

It is thought both groups are yet to fully complete their due diligence, with Village still to update its earnings assumptions based on the shutdown of its cinemas, theme parks such as Sea World on the Gold Coast and other attractions following closures in recent weeks.

It is understood the company has a couple of options available to it to ensure it has enough cash flow for survival, and they are not thought to include an equity raising.

The thinking is that an option will be a cash injection from a buyout fund, potentially from one of the two existing suitors.

Its market value is about $370m and as at December, its net debt was $198m and it had $73m of cash on its balance sheet.

It is estimated by some that the company needs a further $200m to tide it over in the months ahead.

A raise would be problematic for the major shareholder, the Kirby family’s Village Roadshow Corporation, which has a stake of about 40 per cent, where it would probably have to stump up about $80m or have its interest heavily diluted.

Unlike Crown, Village Roadshow has already embarked on a sale and leaseback of its real estate assets, which would have offered some security to a suitor in the current high-risk environment.

Competitor Ardent Leisure, which owns the nearby Dreamworld park on the Gold Coast, still owns its real estate, so when travel restrictions are lifted, this places the company in a stronger position.

Crown’s properties, plants and equipment were valued at $4.625bn in its December accounts.

Given that Blackstone’s real estate business out of Asia executed the transaction, the buyout fund could have aspirations for a sale and leaseback for the casino operator, if not a takeover at a later stage.

Investment bank UBS is advising Crown. The Swiss bank has worked on various sale and leaseback possibilities for takeover targets in recent years, including Caltex and Healthscope, along with Crown itself.

With expertise in the area, it would place Blackstone in the box seat should such a transaction be carried out, although it is thought to be early days with respect to any deal.

Blackstone has owned Las Vegas-based casino Cosmopolitan, Hilton Hotels and the real estate of MGM’s Las Vegas-based Bellagio resort, so is no stranger to the asset class.

A takeover would need government approval and backing from James Packer, who holds about 40 per cent of Crown.

Crown’s property portfolio includes hotels and casinos in Melbourne, Perth and Sydney, as well as a development site in Queensland.

Any deal may only happen further down the track once greater clarity emerges around the state of the residential market following the coronavirus crisis and how this affects apartment sales at its Crown Sydney hotel development at Barangaroo.

Crown’s market value has fallen to $5.82bn, from $8.6bn earlier this year.

The thinking among the market on Wednesday was that the government may enable casinos and theme parks to open within weeks, so any buyer would be obtaining stock in listed groups with such assets at a highly opportunistic price.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout