It’s been a tough year in investment banking, with a lower volume of deal flow and some big transactions failing to complete.

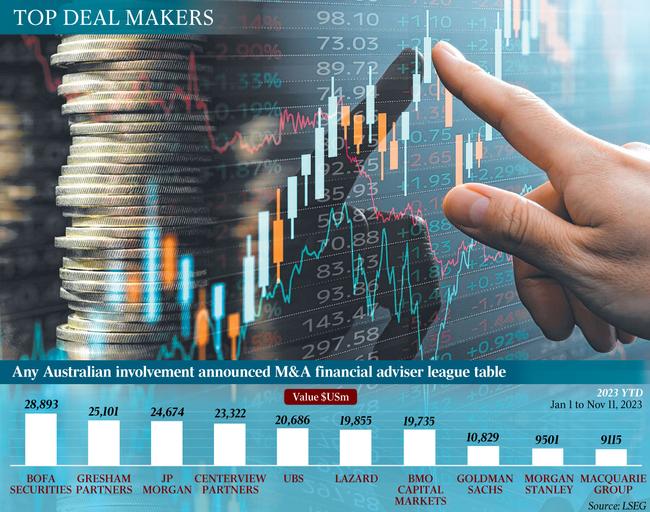

The transactions announced in Australia during 2023 were worth a combined $US103bn, well down on $US142bn for 2022, according to data from LSEG Data & Analytics.

But after taking a break over the summer period, deal makers will be hoping for a far better 2024.

Here’s how it panned out across the different industries and what’s likely to come in the year ahead.

Mining

Albemarle walked away from a $6.6bn buyout of lithium producer Liontown Resources, and SQM’s attempted purchase of another lithium group, Azure Minerals, now looks difficult after billionaires Chris Ellison and Gina Rinehart spoilt the party by amassing blocking stakes in both companies.

The jury’s still out as to whether the $US10bn Allkem lithium chemicals merger with US-based Livent will get across the line.

But making up for it were mergers and acquisitions among the gold miners – the biggest of course was at the start of the year, with US-based Newmont taking out Australia’s largest gold miner, Newcrest, in a $29bn transaction.

The Raleigh Finlayson-led Genesis Minerals also purchased St Barbara assets, and there was Evolution Mining buying the Northparkes copper and gold project for $725m.

And then there was BHP’s highly anticipated sale of its coal assets to Whitehaven in a $6bn deal.

Mining was one of the most active sectors for raisings. At the small end companies capitalised on lithium demand to secure cash to fund projects.

Next year, resources related to the energy transition will continue to be a major theme, as US and Chinese players look to consolidate the market, particularly for commodities used to make electric vehicles, as we’ve seen with lithium.

There’s still plenty of consolidation to play out in the gold mining space. De Grey Mining and Ramelius Resources are two companies to watch, while lithium producer Pilbara Minerals is unlikely to sit still with its cash pile and Patriot Battery Metals is expected to be involved in corporate activity.

Energy

All eyes remain on Santos and Woodside, which are in talks over an $80bn-plus merger. Can the two parties agree on a deal? And will regulators approve it?

They’re the big questions for 2024.

Then there’s the question of whether Brookfield and EIG revive their pursuit of Origin Energy after their $16bn buyout proposal was voted down in December, on the back of opposition from the company’s largest shareholder, AustralianSuper.

Energy transition remains one of the big themes when it comes to M&A, and with plenty of funds being allocated to the space it’s an area to watch.

A Santos-Woodside merger could also lead to further industry consolidation among smaller oil and gas players in Australia.

Other deals in 2023 were APA’s purchase of Alinta Energy’s West Australian business for $1.8bn, Enel’s sale of energy assets to Inpex for just under $1bn and ConocoPhillips snapping up a 2.49 per cent additional interest in APLNG for $500m.

Consumer and retail

The consumer industry was one of the most active spaces for buyouts during 2023, as buyers swooped on unloved stocks in the listed space like Costa (purchased by Paine Schwartz Partners for $1.5bn) and United Malt (snapped up by Invivo’s Malteries Soufflet for $1.5bn). Blackmores was swallowed by Japan’s Kirin for $1.9bn and SILK Laser was purchased by Wesfarmers for about $180m equity.

A standout transaction was L’Oreal buying the Aesop skin care business for $3.7bn.

Then there were the private equity deals – Pizza Hut sold to Flynn Restaurant Group for less than $100m, PAG bought pub company Australian Venue Co for $1.4bn and EQT bought VetPartners for between $1bn and $2bn.

Sadly for TPG Capital, a deal to sell its $4bn animal business Greencross to EBOS stumbled at the last hurdle, while Treasury Wine’s $1.34bn purchase of US luxury wine outfit to DAOU left some investors out of sorts as shares fell amid concerns it paid too much.

In retail, 7-11 was sold to Japanese brand operator Seven & I Holdings for $1.7bn and Viva Energy acquired On The Run for $1.15bn.

Next year, private equity firms have a long list of consumer businesses they need to get off their books.

These include Quadrant’s Rite Bite Group and KKR’s Arnott’s, Greencross, Journey Beyond and Superior Food Services, while consumer companies such as Lite n’ Easy could also return to the market.

All eyes will be on the sale of Mexican restaurant chain Guzman y Gomez, expected to be snapped up by US private equity.

Retail is expected to be closely watched for insolvencies at the smaller end, with reports that operators have been heavily discounting before Christmas to get cash through the door amid a period of weaker spending, while M&A is unlikely to be a major theme.

The big question is whether retail giant Chemist Warehouse will get Australian Competition & Consumer Commission backing for its $8bn-plus backdoor listing into Sigma. Some think it’s line ball.

Health

Investors started to lose patience with healthcare providers in 2023, as higher costs plagued performance, but it’s still a favourite for private equity.

Ramsay Healthcare netted about $1bn from the sale of its half-share of Ramsay Sime Darby to pay down some debt and Bain Capital took out aged care operator Estia after it struggled to fire on the ASX.

Australian Clinical Labs has tried to merge with Healius, but hasn’t had any success, with the target and the ACCC both against the move.

Private equity is keeping a close eye on Australian listed companies, getting ready to pounce when their values fall.

The challenge for operators will be getting prices down and developing business models that make them less reliant on government support.

Some deal-makers expect aged-care consolidation in the year ahead.

The government is offering more support for aged care and general practice medicine, which should improve the performance of companies in 2024.

Technology and media

Consolidation is expected to continue among media companies after ARN Media bid for radio rival Southern Cross Media in 2023.

In technology, the main deals involved Telstra buying tech consultancy Versent for $267m while WiseTech Global delivered on its bolt-on acquisition strategy, picking up US-based transport software company Envase Technologies for $372m and Blume Global for $616m.

Macquarie’s Vocus was unable to make a multibillion-dollar acquisition of TPG Telecom infrastructure work, while smaller deals were announced, including a tie-up between Symbio and Aussie Broadband, and Soprano Design made efforts to buy rival Whispir.

The issue for technology companies continues to be to establish what their real business model is and how the economics works in newer industries.

Tech stocks in big industries are in good shape, but those that are unprofitable will struggle to gain funding.

Large companies are fielding approaches from smaller industry players, but the suggestion is that they need to drop prices.

Financial services

Deals have been pretty thin on the ground for 2023 in the financial services and banking industries.

Much depends on whether ANZ gains regulatory approval to buy Suncorp.

That could put Bendigo and Adelaide Bank, Bank of Queensland or Judo in play.

Perpetual is likely to finally move on the sale of its corporate trust arm after rejecting a $3bn scrip buyout proposal in November from Washington H.Soul Pattinson.

Funds administration business Link remains in focus as a buyout opportunity, as are financial technology groups Iress and PEXA.

Consolidation is seen as necessary in financial services, particularly in areas like buy now, pay later, while the top four banks are set to look for new earnings growth with bolt-on deals to add to their core business of writing mortgages.

One of the smaller deals in the sector was insurance broker Honan Insurance Group’s sale to Marsh for between $500m and $1bn.

Industrials

There are similar themes playing out across industrial and consumer companies – higher costs and slower demand.

The focus in both sectors will be lowering costs and passing on prices, and there could be some job cuts.

It will be a grind through a weaker economic period, as consumers cut back on spending.

Moves to get expenses down will almost certainly see companies keen to meet the market on price.

The consumer sector will face similar trends.

Deals this year have involved building material companies. BGC sold its fibre cement unit and Jeld-Wen Australia to Platinum for about $700m.

Downer sold its recycling unit, while TPG Capital snapped up funeral services provider InvoCare for $1.8bn.

Bus company Kelsian bought All Abroad America for close to $500m, while Raphael Geminder looks set to privatise the long-struggling packaging company Pact after he sweetened the deal and its largest independent investor, Investors Mutual, agreed to sell in.

Incitec Pivot’s sale of its Waggaman facility in the US to CF Industries for $2.5bn was one of the largest deals in the space.

Mining services provider DDH1 and Perenti merged and Onsite Rental sold for $635m to Sime Darby Berhad.

Infrastructure

A lot of players have downed pens until later in 2024, with deals being carried over into the new year.

There will continue to be sales of stakes in toll roads and airports, as investors make fund redemptions to take assets into cash.

Pension funds are keen to retain cash to ensure they have enough liquid assets.

The sector really in favour for deals is data centres – the big one to watch is AirTrunk, set to be chased by Blackstone.

And again, any assets related to the energy transition will be sought after.

Real estate

Real estate bankers will be hoping for more activity next year, and some believe the stars are aligning for a scrip merger between the major office landlords.

Companies to watch include GPT and Lendlease, which has been selling assets during 2023 to lower its debt.

One of the biggest deals of 2023 was HMC Capital’s purchase of Healthscope’s real estate assets for $1.2bn.

The big change in the sector will come when asset values are finally written down to meet the market, which could put pressure on some groups to raise equity to appease lenders.

Some have been surprised there have not been more deals in 2023, with the lower Australian dollar, and the market has risen about 10 per cent in the last month.

Other than that, it’s looking like slow going in the space.

●DataRoom will be taking a break and returning on January 30.On behalf of the team at The Australian, the column would like to thank all of its contributors, readers and supporters and wish them a wonderful summer break. See you in the new year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout