Only days after BGH Capital left the contest to buy Virgin Australia its headquarters remain a hive of activity, with healthcare and wealth management assets said to be in the crosshairs of the private equity firm.

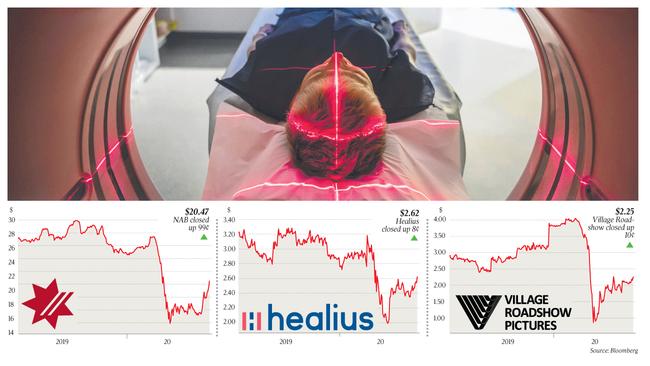

It is understood BGH is shaping up as the frontrunner to buy the Healius medical centre division, which is up for sale through investment banks UBS and Morgan Stanley.

BGH is also expected to be a strong contender for NAB’s MLC wealth management business, which it is known to have had interest in for some time.

MLC is on the market through Morgan Stanley and Macquarie Capital.

An information memorandum is in the market and first-round bids are due this month.

Some question whether NAB has suddenly ramped up its sales plans for the wealth manager because BGH has shown some serious intent as a buyer in recent days, now that Virgin is no longer within reach.

BGH had 40 people working on its Virgin tilt and most assumed it would be too distracted to vie for other assets before it failed to make the shortlist of the contest last week.

But now that is no longer a distraction, the prediction is it will work hard to buy other businesses that make sense for the group.

It raised $2.6bn in 2018 and has yet to put much of that to work two years on.

Market experts believe BGH will be a strong contender for MLC because it counts former Macquarie Capital boss Robin Bishop among its founding partners.

Bishop worked on the $14.6bn merger of Axa Asia-Pacific with AMP while at Macquarie, so has experience in the sector.

BGH was last year circling MLC and the Commonwealth Bank’s wealth management assets, as reported by DataRoom at the time.

The CBA wealth management business Colonial First State was sold last month to US firm Kohlberg Kravis Roberts in a $3.3bn deal.

The thinking is that KKR will take time bedding down that business before pursuing more acquisitions in that space in the short term, although Blackstone is also thought to be very active in the local market and a keen buyer.

There was speculation that NAB was nearing a deal to sell the $4bn MLC business to a private equity firm earlier this year and the expectation is that the business is more likely to be sold to a buyout fund than demerged or floated by the bank.

Since raising funds in 2018, BGH’s largest deal has been the $2.1bn acquisition of Navitas.

It was an underbidder for the private hospital operator Healthscope that sold to Brookfield for $4.4bn and recently walked away from a deal to buy New Zealand dental care business Abano Healthcare due to changes in its performance linked to the coronavirus.

Various banks have been sounded out about funding options to buy the portfolio of 96 medical centres and day hospitals.

The division’s asking price is believed to be at least $500m and it is understood final bids are due shortly.

BGH is also closing in on Village Roadshow.

Some believe that the $400m-plus bid for Village Roadshow is a gutsy move by BGH at a time when the future of cinema chains offshore, such as US-based AMC Entertainment, is hanging in the balance due to COVID-19 disruptions.

Others see the deal as highly opportunistic.

Village announced last month that BGH was in exclusive talks to buy the business for close to half the price it offered earlier in the year due to the change in trading conditions.

Time has been running out for the Village due to forced COVID-19 related closures of its cinema chain and theme parks such as Sea World and Movie World on the Gold Coast.

All the activity is keeping plenty of investment bankers busy — Macquarie Capital is helping BGH Capital with Healius and JPMorgan and Goldman Sachs are working for the private equity firm on its Village Roadshow transaction.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout