Private-equity firm BGH Capital will probably bulk up Virtus Health with acquisitions should it be successful in buying the business for $607m.

That is according to market experts, who said BGH would probably grow the business where it operates in Singapore and Ireland.

Bulking up Virtus in Australia remains challenging, as evidenced by the recent opposition from the Australian Competition & Consumer Commission it faced buying smaller IVF provider Adora from Healius for $45m this year.

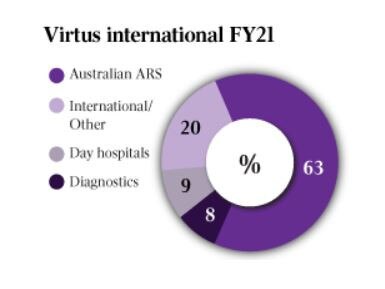

Virtus also has a diagnostic imaging business and day centres, so opportunities exist for acquisitions in that sector as well.

BGH is keen to gain scale in healthcare, but whether its $607m buyout proposal for Virtus gains backing from the target’s board is yet to be seen.

Not far from the minds of investors will be its recent $1.3bn buyout proposal for global software provider Hansen Technologies – it walked away from the listed group after carrying out due diligence without putting forward a binding offer.

The buyout fund is also said to be a keen acquirer of dental care assets – it may target Ekera Dental, which many are predicting will be put up for sale by The Growth Fund next year for up to $200m.

Another business that has been keenly sought by private-equity funds such as Pacific Equity Partners and BGH Capital is Vision Eye Institute, which may also be on offer by its Chinese owner Jangho for about $300m or more.

BGH also purchased the Healius medical centre portfolio last year for $500m and, while some believe it will stage an exit of that business from June next year, others say a sale would be some time away.

Virtus shares closed up nearly 35 per cent on Tuesday at $7.01 on the news of the BGH buyout proposal, at $7.10 a share. It came after a UBS-advised raid on the stock on Monday night. BGH amassed a 9.99 per cent holding in the business at $7.10 a share and entered into a total return swap with UBS that has yet to settle for a 10 per cent stake.

Jefferies and Gilbert + Tobin are working with Virtus.

Virtus shares on Monday had closed 14c lower at $5.21 and its market value was $458m.

BGH Capital’s rival, Pacific Equity Partners, floated Virtus in 2013 in a deal that gave it a market value of about $500m.

DataRoom tipped on Monday that BGH Capital may be the suitor. It is founded by former TPG Capital executives including Ben Gray and Simon Harle and former Macquarie Capital boss Robin Bishop.

IVF groups are said to have outperformed other areas of the market amid the pandemic. Private equity groups typically gravitate towards the healthcare sector as they cash in on the ageing population trend.

However, the listed rival to Virtus, the $366m Monash IVF has been outperforming Virtus and taking market share.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout