The growing list of parties interested in recapitalising Virgin Australia will have a chance to closely scrutinise the business this week when information memorandums are released, as parties such as BGH Capital appoint advisory firms to represent their interests.

The move comes as Regional Express Airlines is the latest company said to be circling the collapsed Virgin Australia, potentially to take on some non-core regional routes as part of a consortium.

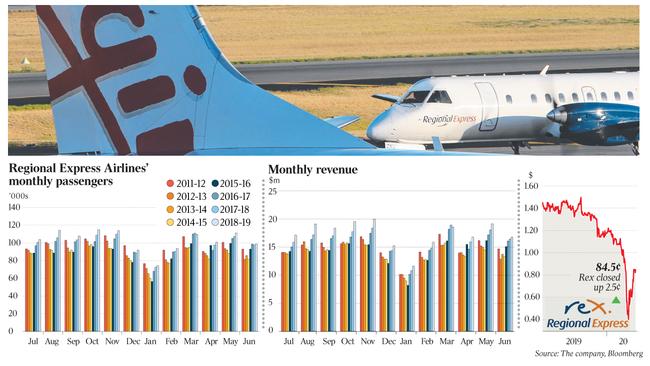

Based in Sydney, Rex, as it is known, operates scheduled regional services and is the nation’s largest regional airline outside of interests owned by Qantas, with 57 aircraft flying to 60 destinations.

The listed airline is chaired by wealthy Singaporean entrepreneur Lim Kim Hai, who holds a 17.25 per cent stake, according to Bloomberg data.

While it has been named as being around the edges, experts have played down the likelihood of any major involvement in a recapitalisation.

Rex is offering government-subsidised services within Queensland and Western Australia and one weekly flight between regional and remote communities and has said publicly that without regional assistance it would collapse.

The Australian revealed on Friday that private equity firm BGH Capital was understood to have tapped advisory firm Moelis, chaired in Australia by Andrew Pridham, for a potential recapitalisation of Virgin Australia.

BGH Capital is understood to have been in discussions with Virgin Australia for about two weeks, a similar time frame to when Deloitte was involved with the company, and had been in the airline’s data room as recently as last week.

BGH has raised $2.6bn for its first fund launched two years ago, but some suspect that it would be unlikely to vie for the airline alone and would work as part of a consortium. Typically, BGH works with AustralianSuper on deals. Founders and partners of the firm include TPG Capital executives Ben Gray and Simon Harle, along with former Macquarie Capital head Robin Bishop.

Others to involve themselves in a Virgin Australia recapitalisation are former Macquarie Group boss Nicholas Moore, who is working as a government adviser, while former UBS Australia boss Matthew Grounds has been advising the federal Treasurer’s office, according to sources, and his former offsider Guy Fowler could have a role with Virgin.

Melbourne-based lawyer Leon Zwier of Arnold Bloch Leibler is also working for BGH.

Deloitte is working as administrator of the airline while Houlihan Lokey’s Jim McKnight is providing restructuring advice on its $5bn-odd debt pile after working on other high-profile corporate collapses in the past.

Virgin Australia collapsed last week with debts of about $5bn after being brought to its knees by the coronavirus travel restrictions. Bids for the company are due in four weeks and binding bids are due in June.

Meanwhile, Virgin’s bondholders, who are owed about $2bn, are believed to be forming a committee to represent their interests ahead of the first creditors meeting this week.

Law firm Corrs Chambers Westgarth is representing some of the bondholders’ interests.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout