Activity appears to be ramping up again in the coming weeks with initial public offering prospect Best & Less.

The group is said to be moving in the direction of a cornerstone process in a similar way to other float hopefuls that have recently hit the market. The understanding is that Best & Less will produce analyst research next week ahead of a management roadshow, should all go according to plan.

Owner Allegro Funds Management has been working towards a listing of the retailer it purchased in 2019 as it also remains on tenterhooks over whether it is the successful bidder for Toll Holdings’ Global Express unit.

Final bids were due last Wednesday for the Toll unit. The contest was understood to be one between Allegro and US-based Platinum Equity.

Best & Less has held several site visits for prospective investors since the start of the year. Whether a float happens will come down to price.

Already, some fund managers are suggesting that the business would have to be priced at between seven and eight times its net profit to win them over.

Earlier, Allegro was understood to have been hoping to achieve a market value of about $400m for the business, with its annual earnings before interest, tax, depreciation and amortisation understood to be about $55m.

Macquarie Capital is working on the float.

Best & Less Group is made up of brands that include Best & Less and Postie in New Zealand.

Chaired by former Just Group boss Jason Murray, the discount clothing and household linens chain was purchased by Allegro Funds Management from the local arm of Steinhoff International, Greenlit Brands. The acquisition was part of a wider deal by Allegro in which it also bought Harris Scarfe, which was later placed into receivership and sold off to the Spotlight Group.

Between 2017 and 2020, online sales for Best & Less rose 50 per cent in terms of compound annual growth rate, as it invested in digital initiatives.

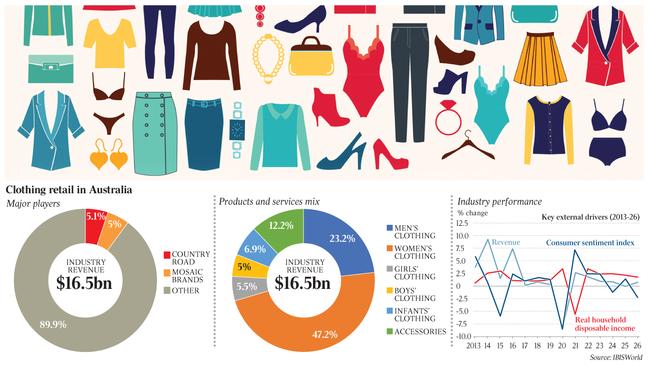

Fund managers late last year were told that baby and children’s clothing comprised about 51 per cent of sales and the business was being pitched as a comparable to Baby Bunting.

Best & Less has recorded sales growth from $605m in the 2019 financial year to $619m in the 2020 financial year. For the past 12 months, like-for-like sales growth was about 8.5 per cent, at $629m. It has cut back the number of stores in its portfolio.