Bain in the mixer for juicy boost in equity offerings

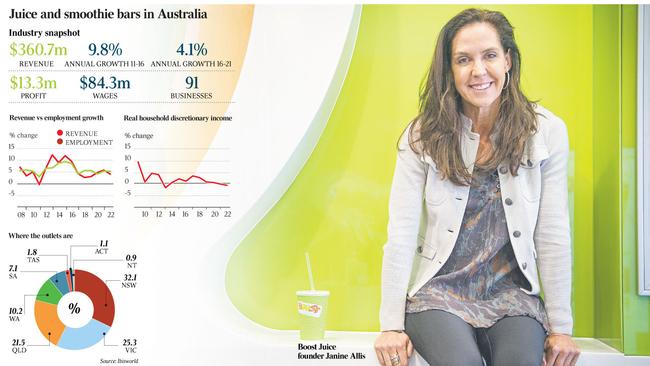

US private equity outfit Bain Capital looks set to become the latest buyout firm to capitalise on the revitalised equity markets as it eyes an initial public offering of its fast-growing food business Retail Zoo, owner of the fresh juice chain Boost Juice, early next year.

Bain snapped up 70 per cent slice of the quick-serve restaurant operator and franchiser in 2014, alongside Boost Juice founders Janine and Jeff Allis, in a deal worth about $185 million.

While the US buyout firm, which floated accounting software giant MYOB last year, has yet to decide on an exit for Retail Zoo, investment bankers are bracing for an IPO as early as the end of the year. However, it is understood Bain has tentatively pencilled in a selldown for early 2017.

News of this latest mooted float signals a growing confidence in the IPO market, which shuddered to a halt earlier this year amid wider concerns about volatile commodity prices and the economic outlook for China. But private equity-related deals had also lost their allure following the poor performance of a number of sponsor-backed floats and the catastrophic collapse of Dick Smith.

Since then, however, equity and credit markets have rebounded, and failing a Brexit shock, investment bankers are anticipating a busy end to the year. TPG Capital’s decision to list its poultry empire, Inghams Enterprises, is reflective of this more sanguine mood.

Yet while investors will alway assess each company on its merits, the demand for growth companies is likely to render Retail Zoo a popular ASX contender.

Bain, which was co-founded by former Republican presidential nominee Mitt Romney, tipped Retail Zoo into its $US2.3 billion Asia Fund II, which was formed in 2012, and sunk 50 per cent of cash into the investment. Its advisers, Nomura, underwrote the debt before syndicating out to other lenders.

If Bain opts to venture down the IPO path, investors will likely compare the business with Retail Food Group, which trades on a hefty earnings multiple.

Bain is also no stranger to the fast-food trade. It holds a stake in Skylark, the biggest restaurant chain in Japan and sold 75 per cent of Domino’s Japan to Domino’s Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout