Australia’s top four banks are believed to be continuing to assess their strategies for operations across the Tasman as they brace themselves for higher capital requirements being handed down by the Reserve Bank of New Zealand.

While one school of thought is that the banks could be mulling a decision to hive off the subsidiaries altogether, the thinking among many in the market is that such a move would be highly dramatic and unlikely, given that they are strong providers of revenue and seen as core to their operations.

However, there is also discussion that at a high level, the financial powerhouses could be examining whether to scale back certain offerings or sell off loan books as return on equity remains a key focus, particularly for ANZ boss Shayne Elliott.

One idea doing the rounds is that Westpac and the National Australia Bank subsidiary, Bank of New Zealand, would sell down their agriculture lending books that are estimated to be worth about $700 million and $1 billion respectively.

But some say that agricultural lending would be tough for a lender that was not one of the

top four banks because it was difficult to do without a banking licence.

However, others say that on the contrary, the NAB is considering a move to distance itself from all activities across the Tasman except largely small business lending and agriculture lending, although a NAB spokesman says this is not the case, while Westpac is looking at a partial selldown — probably through an initial public offering.

But one analyst says that this option for Westpac would not solve all of its problems and would come with much risk.

There is also speculation that the Commonwealth Bank’s New Zealand subsidiary ASB could be looking at an exit of all elements of lending except mortgages. ANZ’s intentions remain unclear.

In Australia, some question whether NAB is also looking at narrowing its focus to small business lending and agriculture, but still embarking on large-scale infrastructure funding.

It comes at a time when all banks are examining their portfolios to determine where they can receive an adequate return on equity following the royal commission into banking.

The plan remains to simplify and focus on core operations.

The new minimum capital level requirements to be introduced by the Reserve Bank of New Zealand, which will soon come into force, will substantially lower return on equity levels for banks in New Zealand, leaving their Australian owners assessing if they are better off selling the operations and reinvesting the money elsewhere.

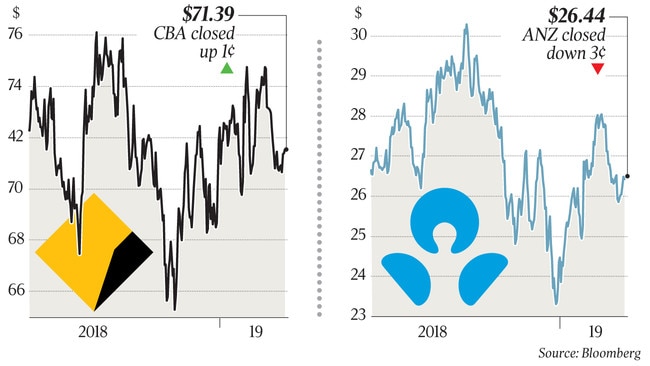

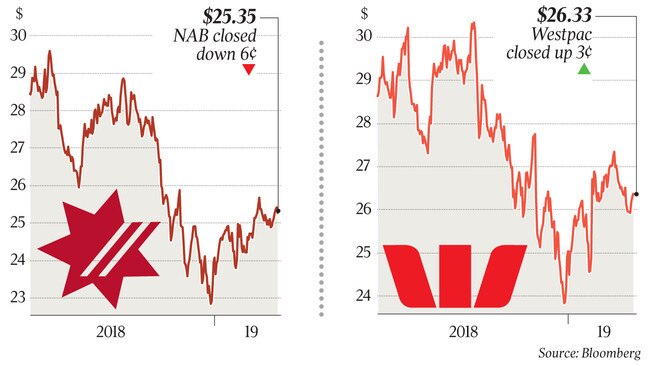

ASB Bank accounts for about 6 per cent of CBA’s earnings and about 12 per cent of revenue, while BNZ generates 14 per cent of earnings for NAB. For ANZ, New Zealand is about one-third of its earnings.

Return on equity for New Zealand banks would be about 7 per cent under the law changes, compared to about 8 per cent for NAB and 11 per cent for CBA, at a time banks are looking to boost ROE levels to about 15 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout