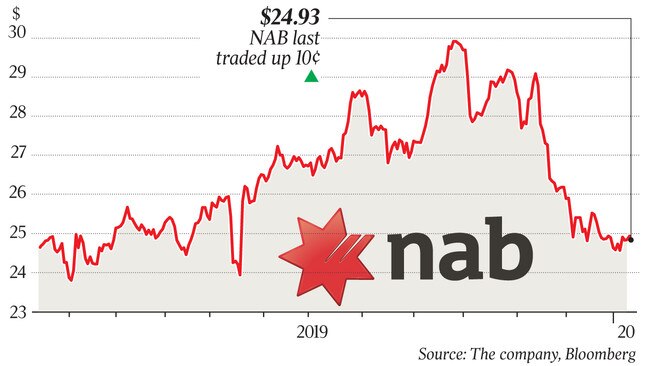

A sale of the National Australia Bank’s $3bn-plus MLC wealth unit is believed to be close, with the Australian lending powerhouse understood to be negotiating with a party in the hope of finalising a deal in February.

It comes after newly appointed chief executive Ross McEwan started with the bank late last year, and he will no doubt be examining various operations closely.

In 2018, there were plans by the NAB to launch an initial public offering for the business, but then speculation started mounting that the operation was more likely to be sold.

The bank’s management then delayed the sale until this year due to the Hayne royal commission, and speculation started mounting late last year that a sale could be once again moving forward.

Earlier estimates had the unit’s value at between $3bn and $4bn.

While Japanese groups have been earlier acquirers of such businesses, it is understood that this time, it is another party in the negotiations.

In the past year, private equity firms have shown interest, with Hellman and Friedman, Apollo and BGH Capital all said to have been circling, while The Australian also recently reported other names of groups eyeing the business such as Kohlberg Kravis Roberts, CC Capital Partners and TA Associates.

In 2016, NAB sold its life insurance operations to Nippon Life for $2.4bn.

Working on MLC over the past year has been Macquarie Capital and Morgan Stanley.

Australia’s largest banking institutions have been moving to focus more on their core banking operations and have been selling supplementary operations such as wealth managers as they face more scrutiny and regulation after the finance industry royal commission.

MLC provides investment, superannuation and financial advice to corporate, institutional and retail customers.

It was owned by property and investment firm Lendlease, which purchased a 50 per cent interest in the early 1980s before later acquiring the remainder.

Lendlease then sold the business in 2000 to the NAB for $4.56bn in what was at the time one of the largest mergers in Australian corporate history.

In September 2018, Geoff Lloyd was hired to run MLC after running the listed wealth manager Perpetual from 2012 to 2018.

Buyout funds globally have been interested in acquiring companies in the lending space amid a low-interest-rate environment as they also ramp up for further acquisitions.

TPG Capital was understood to have looked at buying a stake in Liberty Financial, but walked away from a deal, as reported by DataRoom in November.