The mergers and acquisitions boom on in Australia may appear to be hitting fever pitch, but some are suggesting that there is more to come.

One point of focus right now in the market is APA Group.

Speculation has been swirling in the market that global investment banks JPMorgan, Macquarie Capital and Goldman Sachs, are working on a $2bn-odd equity raising for an acquisition to be announced next month.

One suggestion is that it is APA Group that could be the group that the banks are involved with.

APA Group has a market value of $11.5bn and has previously been in search of acquisition opportunities in the US. It declined to comment on the speculation.

Working for the company in the past to find a target has been JPMorgan.

The understanding is that the APA would have limited opportunities buying pipeline assets in Australia due to concerns from the Australian Competition and Consumer Commission, so most market experts believe that any acquisition would likely be for an offshore target.

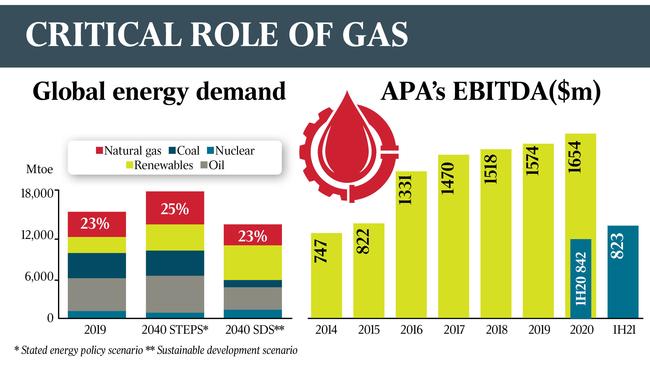

APA, which owns $15bn of gas infrastructure and electricity assets, is said to need acquisitions to continue to fuel growth, but it can be tough for listed groups beating unlisted funds on price, in the search for opportunities amid a low interest rate environment.

The company is due to report its results on August 25 so no doubt merger and acquisition activity will be one line of questioning.

Some had earlier wondered if takeover target Spark Infrastructure had been on its agenda, which Kohlberg Kravis Roberts and Ontario Teachers are offering to buy for $4.9bn.

APA Group, which now counts former Morgan Stanley infrastructure banker Julian Peck as its head of strategy, had earlier told the market that it has an interest in regulated electricity assets when it comes to acquisitions.

However, most believe a rival bid from APA is unlikely.

APA has a close relationship with former suitor CKI, which jointly owns electricity assets with Spark.

The Australian reported in May last year that APA may pounce on distressed US assets as gas players buckle under heavy debt loads.

But at that time, the company warned a Democrat win in November’s election in the US could hobble the development of new pipelines.

APA told the market it was conducting due diligence on US targets in a potential $2bn to $4bn deal as it looked to add a higher margin business to its regulated Australian earnings.

This was after last year’s oil market crash had hiked pressure on the midstream sector including pipeline operators, processing facilities, gas gathering systems and LNG terminals which could see companies place assets on the market to raise capital.

However, it has since staged a massive recovery.

At that time, APA confirmed that while it did not expect to raise equity during the current downturn, it would consider tapping shareholders if it proceeded with a US deal.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout