ANZ may break up its wealth management division

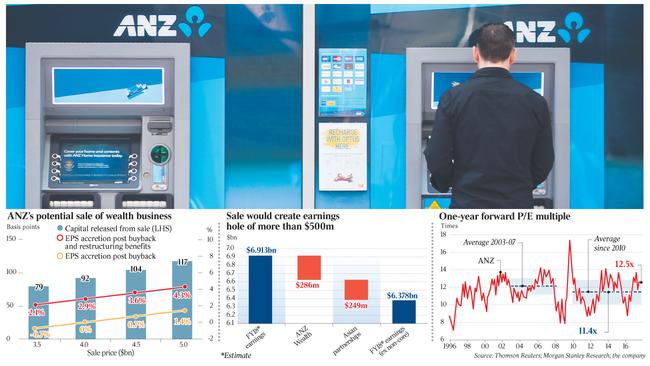

Speculation is mounting that ANZ is considering a break-up of its $4 billion wealth management division and selling off parts to different suitors.

Sources have suggested that executives at ANZ are coming under internal pressure to get a deal away after the sale process has dragged on.

The understanding around the market is that Zurich and Metlife remain in talks with the Australian financial powerhouse about buying parts of the operation, while a float or a demerger of the entire division also remains on the table.

Investment bank Goldman Sachs has been working on the plans for ANZ for several months, leaving some questioning when the process will reach a conclusion.

Bids were due on September 15.

However, the understanding is that offers from Zurich, which has been working with Credit Suisse, and Metlife, which has Morgan Stanley in its corner, are below the bank’s expectations.

One theory is that ANZ will sell the life division within the wealth management arm to either Metlife or Zurich, while the remaining wealth management platform finds another buyer.

Listed wealth manager IOOF is known to be an eager acquirer of ANZ’s remaining wealth management platform, but market analysts question whether the listed group, run by Chris Kelaher, will pay enough to satisfy the bank.

Earlier, AIA was pursuing the business, aided by Deutsche, before acquiring CBA’s life insurance arm for $3.8bn, in a deal assisted by Evercore.

Some say that the bank would be unwise to split up the operation in a move that would lessen its overall value, but others have suggested that it may be the only way ANZ is able to get a deal away.

Still, a split may just not add up for ANZ, given that NAB’s efforts to hive off its life insurance operations in its wealth management division to sell to the Japanese proved costly.

Critics have suggested that ANZ may have been too choosy in terms of its suitors from the onset, excluding private equity funds from the process and insisting any buyer would need to retain an agreement with ANZ where it generated white label products but continued using its branding.

The move is part of a strategy by chief executive Shayne Elliott to pare back ANZ to a traditional banking model.

Meanwhile, as revealed online by DataRoom yesterday, Suncorp will send out information memorandums today for the potential sale of its $1.5 billion life insurance operation.

Four or so parties — most of which are offshore — are said to be circling the business, which is subject to a strategic review and potential sale through Luminis Partners and Nomura.

The operation has previously been estimated to have a value of about $1.5bn, but time will tell what price the division will attract from buyers.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout