Fortescue Metals, backed by mining billionaire Andrew Forrest, is said to mulling a purchase of the Greenbushes lithium mine in Perth, thought to be worth between $3bn and $5bn.

The West Australian is also believed to be considering a tilt at the collapsed airline Virgin Australia through investment bank Credit Suisse. The first creditors meeting for the carrier was held on Thursday.

The lithium mine is one of the best in the world.

Grant Samuel is believed to be advising one of its owners, Tianqi Lithium, for a potential sale of the holding company to support the financing.

The mine stake is owned through the Talison Lithium, of which Tianqi Lithium has a stake, while the US-based Albemarle Corporation holds 49 per cent.

Talison Lithium has been producing lithium at Greenbushes since 1983.

The area has the world’s highest grade and largest hard rock deposit of the lithium mineral spodumene.

Located 250km south of Perth, Greenbushes had the first lithium processing plant commissioned in 1985.

Some question whether Tianqi Lithium would sell Greenbushes, with an expectation it would be more interested in refinancing the asset.

Fortescue has made it known that it is eager to diversify away from iron ore investments into minerals like lithium and copper used for new technology such as electric cars.

Its focus has been on exploration opportunities rather than acquisitions.

Mr Forrest is the major investor in Fortescue Metals Group, with his investment company Minderoo Group holding more than 30 per cent.

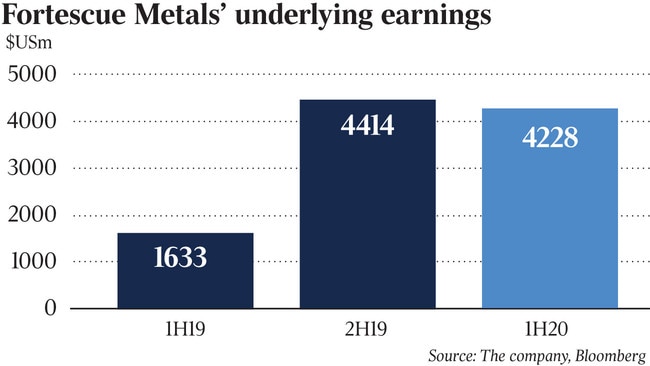

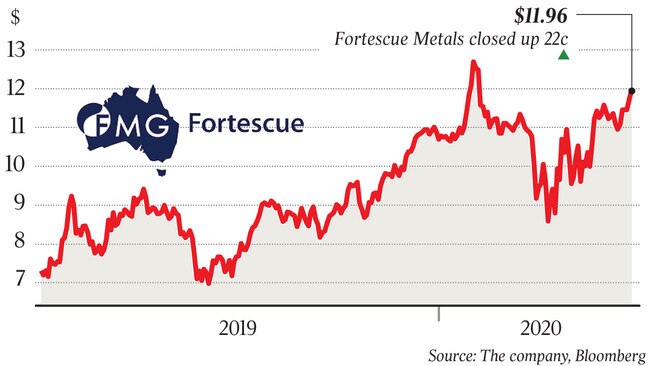

Minderoo has secured dividends in the company worth more than $2bn since the beginning of last year, as iron ore prices and strong export volumes propelled Fortescue to a $US2.5bn half-year profit in December.

Potentially joining Forrest’s pursuit of Virgin are heavyweights Brookfield, Macquarie Group, Wesfarmers, Moelis-advised BGH Capital, Bain Capital, Indigo Partners and possibly Apollo Global Management and Oaktree Capital Management.

There are said to be more kicking the tyres in the sales process run by Deloitte, Houlihan Lokey and Morgan Stanley.

Meanwhile, Faraday Associates was appointed on Wednesday night to represent half of the Virgin Australia bondholders.

The investors are collectively owed about $2bn.

It is understood that PwC and KordaMentha also pitched for the role.

Law firm King & Wood Mallesons is working for a group of secured creditors, while Clifford Chance also potentially has a role.

EY is working for the federal government.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout