Ampol is gearing up for a spending spree, with suggestions that the locally listed fuel retailer is keen on EG Group’s $2bn-odd Australian service station portfolio.

Offshore reports suggest that the British petrol station and fast food outlet owner EG is likely to part ways with its Australian fuel convenience chain only three years after it fought off competition to buy the portfolio for $1.7bn.

It is understood that the logic for a sale is that the company is keen to reduce its level of debt.

Sources say that should the assets hit the market, as expected, Ampol wants to compete for the portfolio.

The $6.6bn Ampol is embarking on due diligence to buy its New Zealand rival Z Energy for $1.9bn and is also among a group of suitors looking at the $1bn Australian portfolio of Meridian Energy that is currently on offer.

Ampol’s strategy has been to take a more environmentally friendly approach in the future and gear up for the emergence of electric vehicles.

EG Group lobbed a bid for the Ampol business early last year. EG proposed paying $3.9bn in cash for Ampol’s convenience retail business with the existing fuel and infrastructure division to be listed.

However, the proposal was rebuffed.

Working for EG that time around were investment banks Jefferies, Bank of America and Citi, which may turn up alongside EG again if it moves forward with Australian sale plans.

EG Group’s Australian business consists of the 540 fuel convenience sites it purchased from Woolworths in 2018.

It operates thousands of sites across Europe and North America.

Woolworths placed the assets on the block after running an earlier sales process, where BP won the competition to buy the portfolio for $1.8bn in 2017.

However, that transaction was blocked by the Australian Competition & Consumer Commission.

In that contest, Ampol (then named Caltex Australia) was an underbidder.

ACCC chairman Rod Sims said at the time that he believed fuel prices would have increased at the Woolworths sites under BP’s ownership.

Ampol supplies fuel to the nation’s largest branded petrol and convenience network as well as refining, importing and marketing fuels and lubricants.

It has 16 terminals, six major pipelines, 55 wet depots and about 1900 branded sites, including about 700 company-controlled retail sites, along with the Lytton oil refinery in Queensland.

Ampol last year netted $682m after selling an 80 per cent stake in a petrol station network of 250 sites to Charter Hall and GIC.

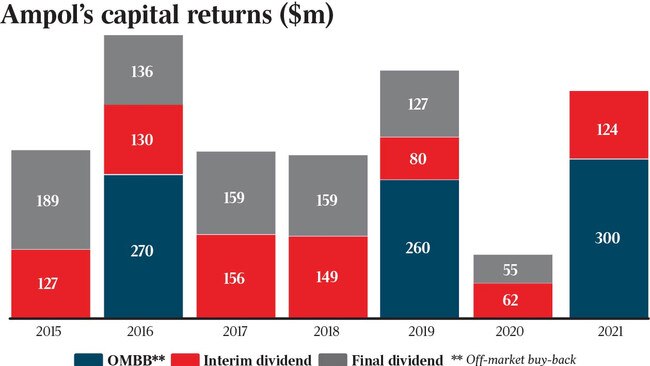

The company completed a share buyback in January.

Its shares closed on Tuesday up 3c at $27.82.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout