It has emerged that it is not only AMP’s funds management business that US-based Ares Management has had its eye on — Challenger Financial has also been on its radar in the past year.

DataRoom understands Challenger’s management team led by Richard Howes weighed a move in the past year to spin off all of its funds management operations, including its Fidante business and its CIP Asset Management division.

Ares, which is currently carrying out due diligence on AMP, at the time was understood to have been an interested buyer. The plan never progressed because Challenger’s board was unsupportive of the proposal.

Analysts say Challenger’s life insurance arm has a low return on equity, unlike its funds management operations, which would have likely be the deterrent for the board.

Asset manager Fidante has also been considered a stand out performer for Challenger.

Howes became Challenger’s chief executive two years ago, taking over from Brian Benari, who is now a founding partner and CEO of the recently formed investment bank Barrenjoey Capital Partners.

Challenger came under focus last year with speculation that its Fidante funds management business was up for sale. It centred on spinning off the business into a fund of which Challenger was a shareholder.

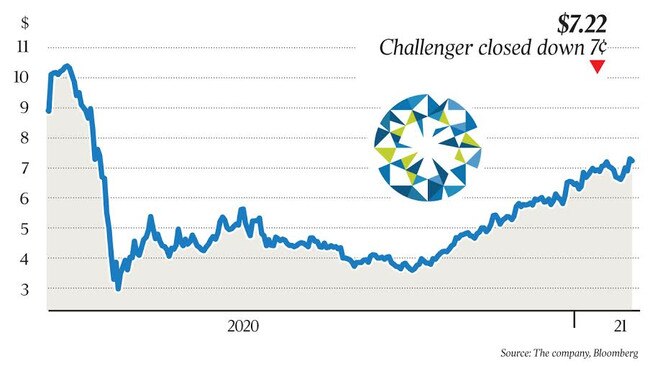

That was followed by talk that private equity was circling the $5bn company, with suggestions Carlyle was weighing a bid.

Challenger and Ares, which counts former Australian and New Zealand investment banking boss John Knox as its chair for the region, already have a joint venture with Fidante, where the pair co-ordinate the marketing and management of retail and institutional investor capital from Australia and NZ for Ares’s various credit, private equity and real estate strategies. The venture is called Ares Australia Management.

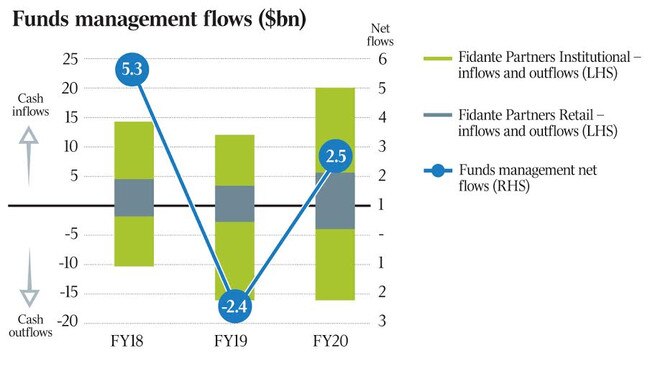

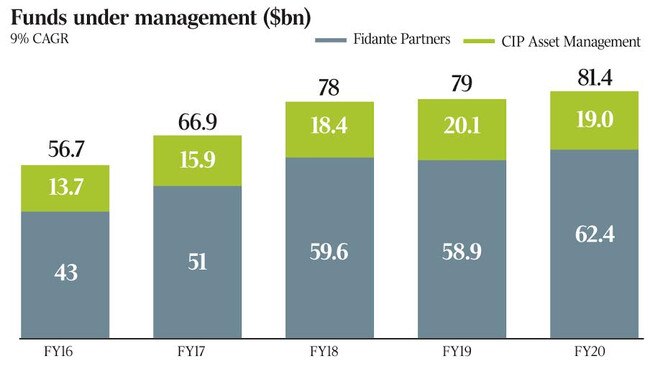

Challenger describes Fidante Partners as Australia’s leading multi-boutique asset manager with offices globally and $62.4bn worth of funds under management. For the year to June, Challenger’s funds management unit staged a 13 per cent lift in earnings to $58m.

Challenger said its average funds under management, most of which was from Fidante, increased 4 per cent to $80.6bn.

Ares last year made a $1.85 per share indicative offer for AMP, equating to $6.4bn.

The understanding is that Ares wants to gain control of AMP Capital, with the hope of finding buyers for the banking and wealth management operations.

However, expectations now are that it will bid for the AMP Capital division only.

AMP shareholders say such a deal would only be attractive if Ares offered a knock out price.

As of a year ago, AMP Capital had $203bn worth of assets under management. It is mulling asset sales following a decline in performance after the release of the Hayne royal commission findings.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout