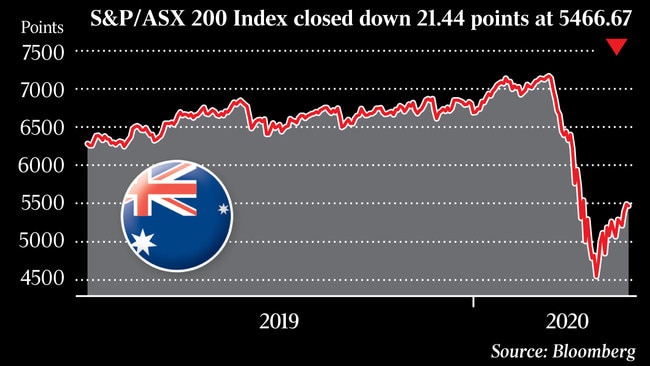

Mergers and acquisitions may have taken somewhat of a back seat to equity raisings amid the coronavirus crisis, but apparently there is still plenty of discussion about possible transactions unfolding in the background.

A lot of talk about opportunistic mergers and acquisitions is happening, although parties are hesitant to act in the current market due to the uncertainty.

This is even though the market declines since the start of the year make some stocks appear to be good value.

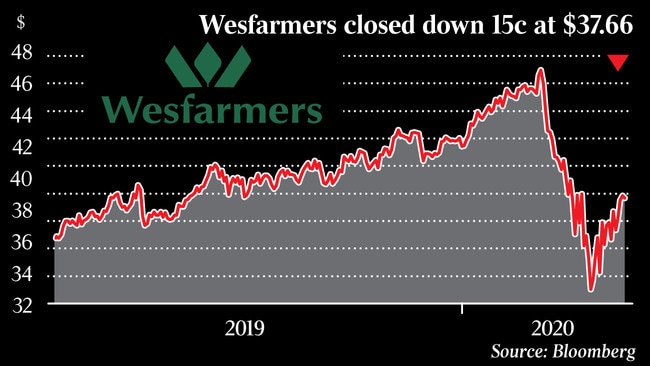

Wesfarmers is considered the best placed for acquisitions, given it is cashed-up on the back of its $2bn-odd selldown of shares in the listed supermarket group it demerged, Coles, and is being shown every possible deal in the market.

Yet the Perth-based conglomerate is consistently discussed as a suitor for various companies.

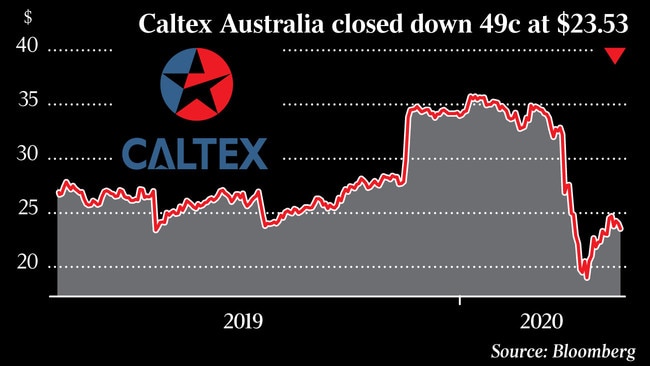

Many eyes continue to remain on Caltex, with talk persisting that its suitor, Alimentation Couche-Tard, is planning to lob a lower, revised bid for the Australian oil refiner and fuel retailer than its earlier $8.8bn bid on the table.

Due diligence has been finalised and adviser Goldman Sachs continues to work on the paperwork for a possible deal that has the support of Couche-Tard’s Canadian lenders. Yet there are still many in the market who remain unconvinced that the Canadian suitor will follow through with a binding proposal amid the current economic uncertainty.

This is despite the highly attractive earnings increases that Couche-Tard can apparently achieve when the company is under its control.

Another possible transaction up for discussion is a sale by Japan Post of its Toll Holdings business.

A beauty parade for investment banks hoping to gain an advisory role for a sale was recently held, and some are pointing to Goldman Sachs as the most likely winner, although the investment bank did not comment on whether it had landed the mandate.

Many believe that any sales process would only start once market conditions improved and have questioned where a buyer would come from for the business, which is expected to be performing relatively well given the exceptional circumstances in the market.

Should it sell Toll Holdings, Japan Post may be forced to take a major haircut on price.

It acquired the company at the top of the market for $6.5bn in 2015 and has since experienced a run of annual losses and major writedowns.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout