Australia’s largest building materials provider, Boral, could be in the crosshairs of a private equity firm with its share price recently trading at almost half its 2018 high.

It is understood that at least one party — thought to be private equity — is kicking the tyres on Boral for what is likely to be a break-up, although any interest is probably at the early stages and may not yet be known about by the listed group.

It comes at a time when a number of deals are apparently being worked on involving listed companies being purchased by private groups.

Large global buyout funds remain awash with cash in a low interest rate environment and they are eager to capitalise on the soft market conditions.

Having suitors circling is understood to be nothing new for Boral, which has had its fair share of buyout funds and competitors look at it in the past.

One group known to have been keen to buy the business in previous years is Adelaide Brighton, although Boral’s $3.5bn acquisition of the US-based Headwaters building materials business in 2016 makes a deal for the $1.9bn Adelaide Brighton alone now out of the question.

The focus for Adelaide Brighton now, if anything in the mergers and acquisitions arena, is a tie-up with its major shareholder the Barro Group.

Some also doubt whether anything comes of the private equity interest, as experts believe a takeover of Boral would be difficult, given that the company would be unlikely to take the offer lying down.

But some investors have over the years expressed frustration with Boral, from which they hoped more and may be willing to accept an offer.

In the years after the global financial crisis, it was Boral’s US operations that disappointed and now some are less than impressed with its performance after the Headwaters acquisition.

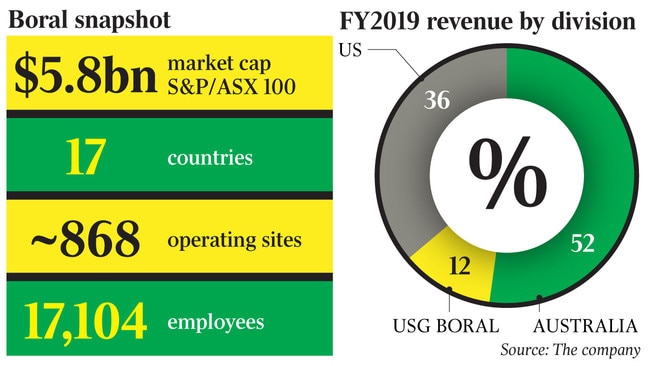

Also, debt could be an issue for a buyer at $2.19bn, against a market value of $5.2bn and some say that the company needs to raise at least $500m of equity.

When Boral purchased Headwaters in 2016, Macquarie Capital, Citi and JPMorgan worked on the raise.

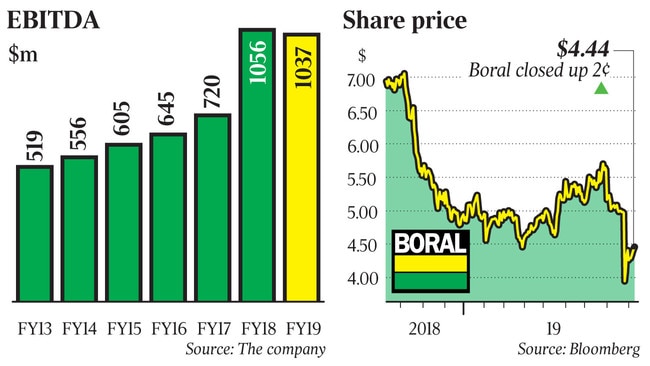

Its shares last month tumbled 20 per cent on the day of its results — its largest fall in a decade — after the company warned of a sharply lower annual profit outlook — 5-15 per cent lower than the 2019 fiscal year — due to delays in Australian infrastructure projects compounding a slowdown in the domestic residential construction market.

It also last month unveiled a long-awaited $US441m ($658m) deal with Knauf to assume control of its local USG Boral business and team up with the German giant to form a new Asian plasterboard venture.

Its underlying profit for the 2019 financial year came in at $440m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout