The a2 Milk Company is believed to be positioning itself to capitalise on its buoyant share price, with the business understood to be one of the final contenders in the competition to buy the $NZ400m ($375m) Mataura Valley Milk company in New Zealand.

It is believed a2 is one of only a handful of parties in the mix for the asset, with some questioning whether the $14bn group could be the strongest contender.

Mataura Valley Milk, based on the South Island, was put up for sale through Macquarie Capital, with an information memorandum circulating in the market.

The company is majority owned by China Animal Husbandry Group and New Zealand company Bodco Dairy.

A2 is known to count Goldman Sachs as its long-time adviser for transactions and is run by Geoff Babidge who returned to the top job at the company after Jayne Hrdlicka stepped down as the chief executive last year.

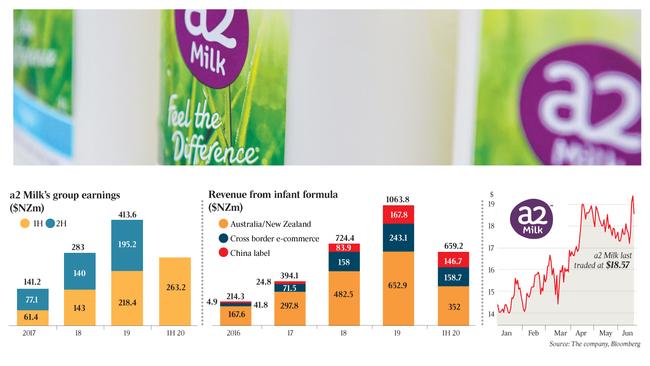

As a trans-Tasman dairy brand, a2 recently became one of the top 50 biggest companies on the Australian Securities Exchange after capitalising on the back of the booming wellness and infant formula markets.

Three years ago, the market value of the business was about $2.4bn.

The shares have soared since April when the marketing company, with its range of dairy products and infant formula produced under contract agreements, upgraded its revenue guidance.

Mr Babidge signalled earlier this year that the company was looking to invest in manufacturing partnerships.

The company previously counted the Sydney-based billionaire dairy farmer and property investor Tony Perich among its shareholders, who sold out his stake of almost 16 per cent in 2015 at a price of about 77c. The shares are now at $19.01.

For the six months to December, a2 staged a 21.1 per cent lift in its net profit to $184.9m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout