Speculation is mounting that a $500m-plus equity raising is looming for AGL Energy ahead of its planned demerger next year.

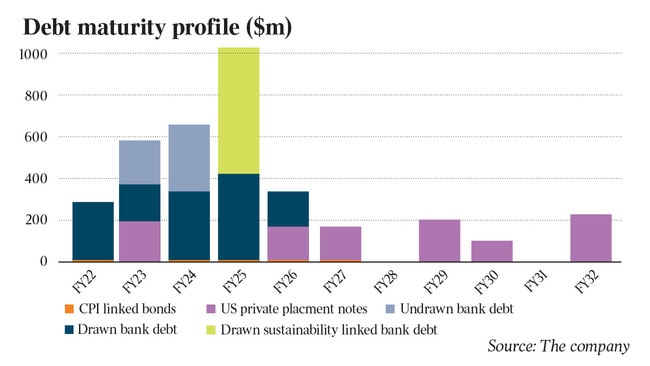

DataRoom understands that a debt refinancing plan for AGL is under way and, while AGL has agreed most terms, a question mark hangs over the loans needed for working capital, expected to be worth several hundred million dollars.

As a result, AGL may need to tap the market for at least $500m, sources say.

This is despite chairman Peter Botten saying a capital raising was not being contemplated when questioned at the company’s annual general meeting this month.

The company has earlier reassured the market that it believes that the measures it has taken to shore up its balance sheet have been adequate, including a reduction of dividends, based on the recovery of the electricity market.

AGL has outlined plans to the market for a demerger next year of its coal-fired power generation division, expected to happen in the first half and it will be called Accel Energy.

According to its financial accounts, AGL had $2.98bn of net debt at June 31 and its overall debt level is about 35 per cent.

AGL has earlier said Accel Energy was expected to have up to $800m of bank debt as well as loans to fund working capital and liquidity requirements in the short term, including revolving cash advance and swing line facilities.

AGL is expected to establish bilateral multi option bank facilities in total worth $2bn, complemented by new US private placement notes that would replace the $910m worth AGL currently holds.

Working for AGL Energy has been Macquarie Capital, Goldman Sachs and Gresham.

Some market experts have suggested AGL’s debt pile is too high for its demerger deal.

But they believe the company has little choice but to forge on, with its exposure to coal weighing on its share price.

Environmentally friendly investors worried about climate change are shunning companies that produce or are exposed to thermal coal, a commodity that produces a high level of carbon emissions when burnt for electricity.

Instead, they are piling into opportunities that focus on clean energy such as those that own solar and wind farms or produce commodities that make batteries used for electric cars.

AGL has been deemed Australia’s biggest polluter and, ahead of its recent AGM, more than half of AGL’s investors that voted were in favour of it setting decarbonisation goals.

Its share price has fallen 55 per cent this year on the back of low wholesale electricity prices and concerns about its future outlook.

Prospective buyers of the $3.7bn AGL have been deterred by its coal-fired assets.

While Chinese-owned Alinta Energy could be a logical contender, it is thought that the Foreign Investment Review Board would block it from embarking on a deal.

Numerous groups are thought to be keen buyers for the business following the demerger.

JPMorgan analysts said this month that Telstra could be a buyer of AGL’s retail business following the demerger, with the telco flagging mergers and acquisitions opportunities and an aim of becoming the fifth-largest energy retailer by the 2025 financial year.

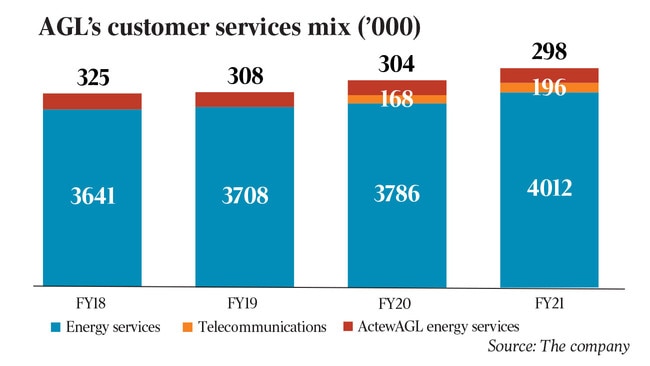

AGL Australia, which provides electricity, gas, internet and mobile services to 30 per cent of households, wants to target full carbon neutrality to chase a higher valuation as a green retailer.

AGL said following the split, it would own and operate the largest private hydro fleet in Australia as well as fast start gas-fired power stations, a growing battery development portfolio and other wholesale and decentralised electricity and gas trading, storage and supply capabilities.

AGL will also own the 20 per cent investment in renewable energy investor PowAR and 50 per cent in AGL’s retail operation Actew. Accel will retain a 15-20 per cent shareholding in AGL.