Could Ramsay Health Care become the next takeover target in the healthcare sector?

The company is the country’s largest and superior private hospital operator and, most importantly, owns about $4bn worth of real estate at a time when landlords to healthcare providers are greatly sought after by risk-averse investors looking to put cash to work.

On the face of it, it looks hard to imagine that Ramsay could be subject to a buyout proposal, given that its market value is $14.5bn and the Paul Ramsay Foundation owns about 19 per cent.

But global private institutional investors like pension and sovereign wealth funds are eager to put funds to work amid low interest rates and like opportunities with a low risk profile.

Market sources say there is a vast amount of capital to deploy.

While the 19 per cent stake held by the Paul Ramsay Foundation makes a deal difficult, it is not impossible.

Healthscope was purchased in a $4.4bn buyout by Brookfield in 2019, with its property portfolio sold off to NorthWest Healthcare Properties REIT for more than $1bn.

It is worth remembering that Australian private equity firm BGH Capital has close ties with AustralianSuper and the pair fought against Brookfield to buy Healthscope in 2019.

The fund is run by former executives at TPG Capital, which was previously a Healthscope owner.

Their modus operandi judging from their former buyouts of companies such as Myer and Ingham’s Chicken is to sell off the real estate separately before later divesting the operating business over time at a higher price.

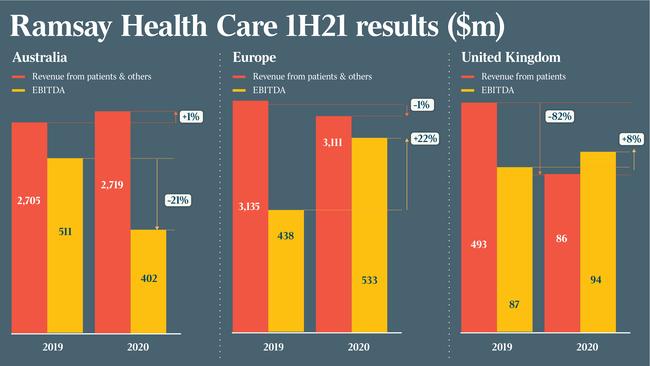

Ramsay is being discussed as a future takeover target as the company itself remains in search of acquisitions, predominantly in Europe and Britain, raising a $1.4bn war chest last year.

The company recently bid $3.9bn for Spire Healthcare but shareholders in the target voted against a move by Ramsay to take control of the British group.

Elsewhere, Australian Pharmaceutical Industries rejected Wesfarmers’ $687m buyout proposal on Thursday, but Wesfarmers is expected to come back with a higher bid.