Neuren Pharmaceuticals, the $1.5bn ASX-listed biotech company that for a few loyal investors has proved a ride of a lifetime, is about to receive something incredibly rare in the Australian biotech sector – a cheque in the mail for drug sales.

Well, not an actual cheque of course, but its first royalties payment based on $US23m ($35.19m) of quarterly sales earned by its blockbuster drug Daybue for the treatment of Rett syndrome, a rare genetic disorder and developmental affliction that can appear in very young children and that has a life expectancy of around 40 years.

For patients it‘s welcome news, of course. For Neuren shareholders it is a payoff for years of work and capital with the biotech’s US partner, Acadia, selling since April the first ever treatment approved for Rett syndrome, which also earned Neuren a milestone payment of $US40m.

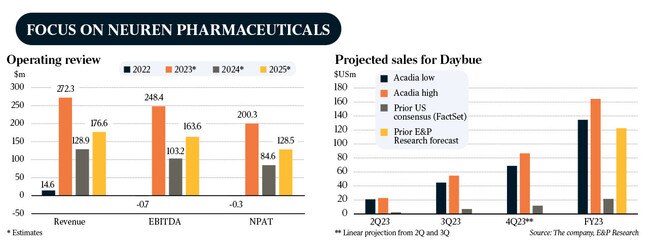

These revenues mean that a first significant profit will be expected in Neuren’s first-half results due out later this month and making it one of the few biotech companies listed on the ASX to actually be profitable.

In July Neuren and its US partner Acadia expanded their partnership to be worldwide, for which Neuren received another upfront payment of $US100m.

The nation’s sharemarket is jam-packed with biotechs that promise the world, spend hundreds of millions of dollars – or billions – to develop a drug only to fall short at the last hurdle, fail to deliver a commercial pharmaceutical and have nothing to show but exhausted cash reserves and a cratering share price.

An expanding audience of institutional investors are focused on the Melbourne-based biotech as it has moved through a transforming series of events led by Phase 3 trial success, FDA approval of the first ever treatment for Rett syndrome, a successful US launch and now significant revenues.

A small group of funds, notably Karst Peak, Milford Asset Management, Antares and Regal Funds Management, were involved at the start of this journey, but many more have moved in, including index tracking funds.

Neuren joined the ASX 300 last year and with a current market cap of $1.5bn – its share price is up 830 per cent in the last five years – and it is tipped to join the ASX 200 soon.

E&P analyst David Nayagam believes there will be an inevitable correction from US analysts that should drive up the price of Acadia, with flow-through for Neuren. Looking forward, E&P’s short-range launch projection has increased 20 per cent for fiscal 2023, representing around a $US15m royalty payment.

Those fundies and investors who follow the biotech sector closely are also getting increasingly excited about another drug in the Neuren pipeline, NNZ-2591, which has applications for a range of neurological disorders. If current Phase 2 studies are supportive, Neuren will now have the sufficient cash to continue development of at least some of these indications into Phase 3.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout