Vifor division head Herve Gisserot is planning to show shareholders how the push into better patient blood management (PBM) will boost his revenues, but recent test results for Denmark-based Novo Nordisk have raised more issues.

CSL’s stock price fell to four-year lows of $238.57 on news that Novo’s new drug Ozempic, aimed at helping diabetics, is showing it can also delay the progression of chronic kidney disease and lower the risk from kidney and heart problems.

The 6 per cent fall in the CSL stock price on Thursday brings to 29 per cent its fall since a 2020 high of $334, or a $46.4bn fall in market value to $115.1bn. Its shares regained some ground on Friday, up 1.3 per cent.

Novo’s potential benefits are precisely some of the health problems Vifor has focused on with its kidney deficiency treatments.

Gisserot, a SmithKline Beecham veteran, was appointed chief commercial officer at Vifor in early 2022, the same year CSL acquired the business in its most expensive acquisition.

The Novo news is certainly not a deal breaker for CSL, but it highlights the competitive dynamics in the global biotech industry.

UBS analysts have described Vifor as a black box showing the market doesn’t yet fully understand the deal, just as it didn’t when the company spent $US525m buying plasma business ZLB in 2000.

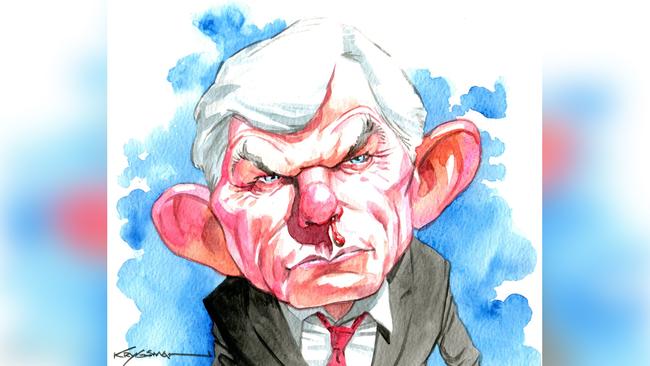

Chairman Brian McNamee, who was chief executive at the time of the ZLB deal, no doubt figures given his track record the market should have more faith.

Since listing in 1994, the company has grown from employing 1350 people to 30,000 (2300 in research), revenues have jumped from $143m to $13.3bn, research and development spending from $17m to $1.23bn, share of sales outside Australia from less than 5 per cent to over 92 per cent, and market value from $300m to $115bn.

The degree of shareholder uncertainty was underlined at this week’s annual meeting in which 23 per cent of shares were voted against a remuneration structure that handed former boss Paul Perrault a sweetheart deal on long-term incentives by excluding the impact of the Vifor deal.

As noted last week, shareholders are grumpy in part because the stock price has fallen from $334.35 to $238, but the optics also did not look great when Perreault retired soon after the Vifor deal.

One of the first moves by his successor, Paul McKenzie, in March was to downgrade what the company saw as some overhyped earnings expectations. Then there were the margin issues with plasma collection as it recovers from Covid slowdowns.

Still, the numbers presented were not too shabby, with revenues up 31 per cent at $US13.3bn ($21bn) and net income up 20 per cent at $US2.9bn, in line with McKenzie’s numbers.

One of the impressive issues with CSL is its long-term investments in research, underlined by the $1.2bn annual R&D spend, and this year’s building program with new centres completed in the plasma-based therapy facility at Broadmeadows, R&D at Marburg in Germany, the vaccine centre in Waltham in Massachusetts and at its global R&D base in its Elizabeth St, Melbourne headquarters.

The building on the fringes of the Melbourne CBD features 850 PHD-ladened research staff working in seven floors of laboratory space laid out to handle more expansion but already using robotics to help the process.

The area is known as the biomedical precinct in Melbourne next to the Doherty Institute, Melbourne Uni, Royal Melbourne Hospital, the Children’s Hospital and Walter and Eliza Hall (WEHI) research centre and the Peter MacCallum Cancer Centre.

Pharma is one industry that benefits big time from artificial intelligence because AI can help predict studies so the company can switch off one avenue if its chosen course is heading for a dead end.

More time saved while maintaining the same due diligence for patient safety can help fast forward the process and better settle new product development.

CSL has its own internal research hub protected by Microsoft to help update programs.

Visitors to the CSL head office labs can walk up steps painted pale green to mimic from where they began in the grasslands of neighbouring Parkville.

There are two floors dedicated to the Jumar Bioincubator, which is a joint project with WEHI, Melbourne Uni and Royal Melbourne Hospital.

The floors will be home to 40 biotech start-ups in a $95m program run by Cicada, with CSL on hand in part to help advise on commercialising new projects.

Each year around the world there are about 310 million surgical operations, which sadly have a 1-4 per cent mortality rate.

The World Health Organisation, looking at the latter numbers, laid down guidelines on how to reduce mortalities and in part this revolved around better patient blood management to reduce transfusions, saving money and in dealing with anaemia prior to surgery, ensuring fewer iron-deficient patients.

Vifor comes to the fore when you are talking iron deficiencies and, with an estimated one-third of patients having elective surgery anaemic, the market is clear.

This market definition provides some upside for CSL to weigh against fears that with Vifor’s Ferinject iron injection coming off patents this year, there will be more competition.

The Novo news this week showed it’s not just patent expiration that is the problem.

ASX chair’s exit strategy

ASX chair Damian Roche is up for re-election at next week’s annual meeting, but like Qantas chair Richard Goyder is expected to tell shareholders he will be stepping down before the next year.

The logical successor is potential Westpac chair Peter Nash, but the former KPMG boss as head of the ASX risk and audit committee has dirty hands in the wake of the CHESS replacement debacle.

ASIC has recently appointed Alan Cameron to keep an eye on the project.

ACSI will be supporting outside candidate former SFE executive Philip Galvin, who is running against two incumbents in Vicki Carter and Luke Randell.

As noted earlier this month, former Mirvac boss Susan Lloyd-Hurwitz would be a worthy successor to Goyder, who like all chairs is responsible with board support for succession at both board and executive level.

Spat over split pipes

A potential billion-dollar fight has emerged between Western Australia’s biggest home builder, BGC, and Fletcher Building (FBU) over FBU’s Pro-fit pipes, which have allegedly burst in Perth at an alarming rate, causing leaks.

BGC argues Iplex used dodgy resins, which was denied at an FBU market briefing on Friday, and the WA regulator in a preliminary report rejected claims the problem was faulty installation.

FBU on Friday piled up its evidence against the BGC claims.

While Iplex no longer sells the pipes, FBU, in the wake of the BGC allegations, did not trade on the bourse for three days this week as it prepared Friday’s defence and investigations continued.

The ACCC has an eye on the issue but so far is leaving it to the WA regulators to deal with, no doubt keen to avoid dealing with angry new home buyers.

CSL, undoubtedly one of Australia’s best companies, has more dark clouds hanging over its head than normal, as it heads into investor day next week with most question marks over its 2022 $18.2bn Vifor acquisition.