CSL gets the investment pumping

At a time when many companies are pumping out dividends, CSL is investing more than $1bn a year in drug trials.

At a time when many companies are pumping dividends into shareholders’ pockets, CSL is investing more than $1bn a year in drug trials to build its pipeline of future blockbusters that its scientists hope will bring rich profits to shareholders.

But the company is not doing so at the behest of Treasurer Josh Frydenberg, who in August issued a rallying call to CEOs to reinvest in their businesses rather than returning excess cash to shareholders.

In fact CSL, Australia’s fourth-largest listed company, is continuing a tradition of R&D that goes back to its founding.

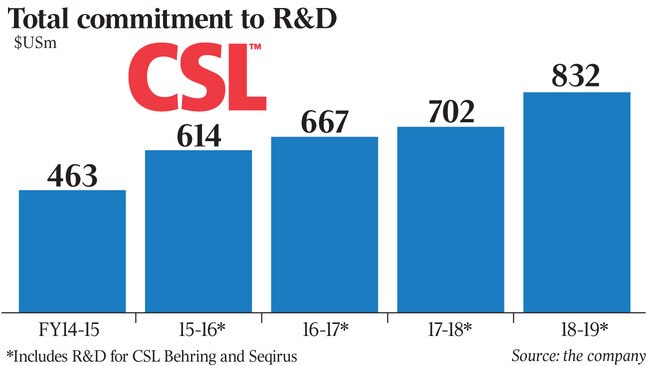

The decision to plough around 10 per cent of annual revenue back into the lab, which in fiscal 2019 amounted to $US832m ($1.2bn), was revealed at Sydney’s Hilton Hotel on Wednesday as CSL’s head of R&D Bill Mezzanote and chief scientist Andrew Cuthbertson AO presented to analysts.

And it wasn’t all about blood plasma. There is a novel treatment for asthma which this month advanced to human trials and could help reduce the 1000 people a day who die from the disease, gene therapies for sickle cell disease and immune deficiencies and work on the crippling Lupus.

“I would say overall the portfolio is the best it has ever been,’’ Prof Cuthbertson, who has been with CSL for 22 years, told The Australian after its R&D investor day.

“If you consider both late stage clinical programs, they are closer to commercial fruition, and we are really excited about some of the earlier stage biotech assets.

“In our industry if you are not investing in innovation through R&D you are exiting because you can’t be competitive.

“It is a strong, balanced portfolio now across the phases and we are quite proud of it,’’ Dr Mezzanote said. CSL invests between 10 and 11 per cent of its revenue on R&D, which over the years amounts to billions which could have been handed back to shareholders in dividends or share buybacks — but that’s not the way CSL does business, especially if it wants to stay in business.

“Some companies would spend a lot less. We would say it is very hard to be competitive and sustained spending a lot less,” Prof Cuthbertson said.

“The reason why I am pleased to take a long-term view is that investing — and I would call it investing rather than spending — 10 or 11 per cent of revenue is a really high quality sustainable investment for our shareholders.

“If you look back over the productivity of R&D over the last period of time it has been a wise investment for our shareholders.’’

Prof Cuthbertson handed over the reins as head of R&D to Dr Mezzanote in the past year, but you get the sense both would mount a strong argument to the CSL board to keep up its investment in new drugs, treatments and therapies.

“If you want long-term prospects then you have to invest in R&D for that long term,’’ said Dr Mezzanote.

“Some companies get themselves twisted up in extremely shortsighted views, what looks good for a year or maybe two, but it doesn’t look so good in five or 10 years.’’

The scientific pair do understand the financial environment they live in, the demands of shareholders and the market, but view the billions sown into R&D as one day providing a wonderful harvest for investors.

“What we are enjoying today when we report our financial results every half year, it is interesting to note the proportion of those revenues and profitability that has come out of R&D investment that we might have made 10 or 15 years ago. And it keeps delivering,’’ Prof Cuthbertson said.

Dr Mezzanote said CSL was building on its leadership in plasma therapies through the identification of emerging new medicines from within its existing portfolio of plasma-derived products as well as pursuing new paths along gene and cell therapies and recombinant proteins.

To support this approach, CSL had forged innovation partnerships in its R&D locations, including at the Bio21 Institute in Melbourne, the Swiss Center for Translational Medicine in Bern, and the University Science Center in Philadelphia, US, the company said.

“Our Phase 3 clinical program targeting the reduction of early recurrent cardiovascular events in heart attack survivors, CSL112, continues to track well.

“We continue our focus on developing new medical indications for immunoglobulins while improving manufacturing efficiencies across our plasma product portfolio,” Dr Mezzanotte said.

Highlighted to investors was a possible treatment for asthma, a common chronic respiratory disease that is estimated to affect as many as 235 million people worldwide and is the most common chronic disease among children. CSL’s latest trial will test the safety of a therapy delivered by subcutaneous injection that asthma sufferers could self-administer at home once every two to four weeks to prevent asthma attacks.