Packer and Crown shareholders back $8.9bn sale to Blackstone, despite facing final hurdle

Most shareholders, including Crown’s biggest investor James Packer, backed Blackstone’s $8.9bn takeover, despite gaming regulators not yet approving the deal.

US private equity giant Blackstone is yet to gain approval from gaming regulators in three states for its $8.9bn takeover of Crown Resorts, despite 99.91 per cent of company’s shareholders - including its biggest investor James Packer - voting overwhelmingly in favour of the deal.

Crown chairman Ziggy Switkowski said Blackstone was still seeking to obtain approvals from casino regulators in NSW, Victoria and Western Australia, which he expected would happen next month.

Once those approvals happen, Mr Packer is set to reap $3.3bn from selling his 37 per cent stake in Crown and ending his family’s decades-old ties with the casino group.

But one shareholder asked if it was “arrogant” to proceed with the vote “before we can even know if any of the three state governments approve a controversial outfit like Blackstone taking control of our politically sensitive company”.

The vote on the $13.10 a share offer - held on Friday morning - had already been delayed once to give Blackstone time to gain the necessary approvals.

Mr Switkowski said the timing of the regulatory approvals, which are key conditions of the deal, was not up to Crown’s board and it should not affect the deal’s “milestones”.

“The regulators in three jurisdictions are still working through, as they must, their various issue,” he said.

“The board considered it was in the interests of shareholders to proceed with the vote today to reduce any potential delays between receipt of the outstanding gaming regulatory approvals and the completion of the transaction, including transfer of funds to shareholders.

“The way the process has developed over the last several months has probably been a bit slower than we had expected because of the nature of the industry and of Crown and the kind of work that has to be done across the jurisdictions.”

The timing of regulatory approvals are difficult to forecast - even from within the regulators. The NSW Independent Liquor & Gaming Authority (ILGA) said in February that Crown was set to receive conditional approval in March to open its gaming floor at its new $2.4bn casino complex in Barangaroo.

But three months later, Crown is yet to receive such approval and its Barangaroo gaming floor remains closed.

Mr Switkowksi also refused to weigh in on concerns about Blackstone owning 150 casinos in central and South American casinos in countries where there can be greater regulatory and compliance risks.

Blackstone became a big player in Latin America after it bought casino giant Cirsa from Spanish billionaire Manuel Lao Hernández for an undisclosed sum in early 2018.

“I’m kind of reluctant to continue what is truly an interesting conversation about the world of Blackstone and that of gaming casinos around the world but I think I need to cut it off at that point, so let me do that,” Mr Switkowski said.

Crown has been the subject of three separate inquiries in NSW, Victoria and Western Australia, which all found the company not suitable to hold a casino licence after it facilitated money laundering and other organised crime.

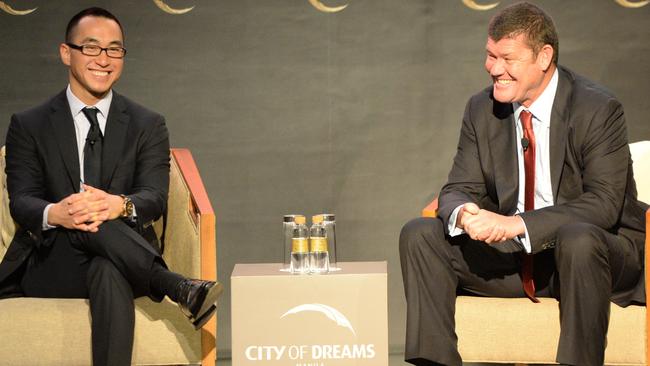

The NSW Bergin inquiry was the first review into the group and began as a probity review after Mr Packer agreed to sell a 19.99 per cent holding in Crown to Macau billionaire Lawrence Ho in May 2019.

Despite the deal not progressing fully, ILGA widened the Bergin Inquiry’s scope to investigate a range of wrongdoing at Crown’s flagship Melbourne casino - including its links to Chinese criminal gangs - ahead of the opening of the company’s new $2.4bn gaming complex at Barangaroo.

Following the explosive revelations during the review, the Victorian and Western Australian government’s launched royal commissions into the group. Meanwhile, ILGA cast a greater spotlight on the casino industry - broadening a regular five-year review into Crown’s rival Star Entertainment which began in March and remains ongoing.

Crown also faces a blockbuster fine from Austrac over countless breaches of anti-money laundering and counter-terrorism financing laws - and another fine of up to $100m from the Victorian gaming regulator over the illegal use of China Union Pay debit cards.

But for Mr Packer, he has emerged 10 cent a share - or $25m - better off under the Blackstone takeover than he was under his share sale agreement with Mr Ho.

Mr Switkowski would not comment on whether Mr Packer’s Consolidated Press Holdings had voted in favour of the deal.

“When it comes to how CPH and James Packer voted, clearly we‘re not going to comment on any individual’s voting decisions. The other hand it’s simple arithmetic from the numbers that have been presented to you to determine that CPH, the vehicle ownership by James Packer organisation, voted in favour of the scheme.”

A “yes” vote is expected mark the end of nearly three decades as a public entity for Crown Resorts.

A final court approval hearing is scheduled for May 24, with the group also applying for a short adjournment during the week starting June 6, subject to receipt of approvals.

A court approval will see Crown delisted from the S&P/ASX 200, potentially prior to May 25, with The Lottery Corporation being included post the demerger from Tabcorp.

The James Packer-controlled Crown listed on the ASX in March 1994.

Mr Switkowski reminded shareholders of independent expert Grant Samuel’s conclusion that the deal is “fair and reasonable” and urged them to back the deal.