CreditorWatch warns that the business sector faces a tough 2023

Business conditions are deteriorating, according to the latest data from CreditorWatch which has warned off increasingly tough times ahead, especially for the hospitality sector.

Australian businesses are bracing themselves for a tough year with a wave of data pointing to worsening conditions as the Reserve Banks signal further interest rate increases in the first half of 2023, according to a leading credit reporting agency.

The January 2023 CreditorWatch Business Risk Index (BRI) found that a number of key metrics continued to decline after a subdued end to 2022.

CreditorWatch chief executive Patrick Coghlan warned that the BRI results indicated a tough year ahead for Australian businesses.

“The upward trend in trade payment defaults, in particular, should definitely be of concern to business owners,” he said.

“The RBA’s tightening of monetary policy is beginning to bite, on top of other challenges like labour shortages and supply chain disruptions.

“We will hopefully see inflation peaking soon, followed by an improvement in business and consumer confidence. It is important to remember that the Australian economy is still in a much better position than most.”

CreditorWatch’s key trade indicator, trade receivables (the average value of invoices), experienced a seasonal drop in January, down 39 per cent from December, but have also been trending downward since July 2022. They were at their lowest point since CreditorWatch began collecting this data in January 2015.

Business-to-business trade payment defaults were down 8 per cent from December to January but are still up 39 per cent net year-on-year. CreditorWatch found that businesses in the hospitality sector were most likely to default due to the multiple challenges they currently face from labour shortages to price hikes to lower consumer demand.

Credit inquiries were up a massive 129 per cent year-on-year in January, following an uptick that began in October.

External administrations were trending upwards until their seasonal drop in January, while court actions were at their highest point since September, up 36 per cent on January 2022.

CreditorWatch chief economist Anneke Thompson, said trade receivables and trade default data were the strongest indication the peak of business conditions was well past.

“While 2023 will certainly be a tougher trading environment for businesses than 2022, we are coming off a period where many businesses were operating at or close to capacity, and the RBA is looking for a slowdown in activity to cool inflation.” she said.

“One of the likely results of this slowing of business activity is rising unemployment. Again, employment conditions have been extremely tight, so any rise in the unemployment rate will likely still see the rate at very low levels in overall terms.”

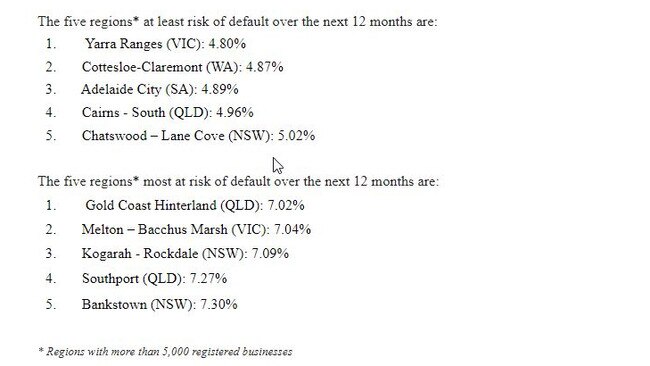

CreditorWatch said on a regional basis, businesses in the Gold Coast Hinterland in Queensland, Melton-Bacchus Marsh in Victoria and Kogarah-Rockdale in NSW are most of risk of defaults in the next 12 months.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout