Coronavirus economic shock ‘worse than SARS’

The RBA has conceded that China’s coronavirus outbreak could hit Australia harder than the 2003 SARS epidemic.

The Reserve Bank has conceded that China’s coronavirus outbreak could hit Australia harder than the 2003 SARS epidemic, but predicts the domestic economy will rebound after a further slowdown in the first half of this year due to the bushfires and the coronavirus.

It came as Nomura predicted a “big economic shock”, with large spillover effects on the rest of Asia.

Asked by the House of Representatives standing committee on economics whether Australia’s much heavier reliance on China could make the impact of the coronavirus epidemic “significantly higher” than the SARS experience, RBA governor Philip Lowe said: “that would be my assessment”.

In updated forecasts released on Friday the central bank predicted the economy would re-accelerate after a further slowdown in the first half 2020 due to the impact of bushfires and coronavirus.

In its quarterly statement on monetary policy, the RBA trimmed its forecasts for growth in the year to June to 1.9 per cent versus 2.6 per cent previously forecast. But it predicted a rise to 2.7 per cent for the year to December 2020 and 3.1 per cent for the year to June 2021.

The RBA’s year-average growth forecast was revised down to 2.25 per cent for 2020 versus 2.75 per cent previously forecast, but it still predicted year-average growth of 3 per cent from 2021.

“More recently, however, the outbreak of a new strain of coronavirus is expected to weigh on near-term growth and has created a new uncertainty for the outlook,” the RBA said.

Sharemarkets recovered this week, with the US market hitting record highs after the People’s Bank of China announced a package of 30 measures to avert panic in its financial markets — including the addition of an extra $118bn of liquidity to China’s financial system via reverse repos.

But economists were still grappling with the economic implications of the epidemic and consequent shutdowns in the world’s No 2 economy as infection and death rates from the virus in China showed no clear signs of peaking, while plans to start reopening factories could accelerate its spread.

“We expect a big economic shock to China with large spillover effects on the rest of Asia,” said Nomura’s head of global macro research, Rob Subbaraman.

Mr Subbaraman added that with confirmed worldwide infections significantly higher than during the peak of the SARS outbreak, “this is a major demand and supply shock”.

Nomura’s “base case assumption” is that the lockdown of dozens of major cities will continue until the end of February and on that basis it expects China’s economic growth to slow from 6.0 per cent year-on-year in the December quarter of 2019 to 3.8 per cent in the March quarter of 2020, before rebounding to 6.4 per cent in the June quarter due to “pent-up production and demand”.

“However, there remains significant uncertainty over the depth, breadth and length of 2019-nCoV, and so our China economists also considered more dire scenarios,” Mr Subbaraman warned.

He said the two main channels by which the virus could hit economies outside mainland China were spillover effects from the disruptions and sharp downturn in China’s economy, and the potential for confirmed cases of 2019-nCoV outside China to start to rise exponentially.

The importance of the former point “should not be underestimated” as the size of China’s economy had swelled to about 16 per cent of world GDP from 4 per cent during SARS in 2003; China was the coal face of the world’s manufacturing supply chain; and its people travelled much more than they used to, with visitors from China to the rest of Asia rising to 90 million in 2019, from 11 million in 2002.

While governments around the world have tightened their border controls, Mr Subbaraman warned that given the long incubation period of 2019-nCoV, relative to SARS, the large number of Chinese travellers and the possibility of a second wave of infections — as happened during SARS around 30 days after the global outbreak started — “the danger of it becoming a global pandemic remains”.

“In that case, other countries would become directly exposed to local demand and supply shocks.”

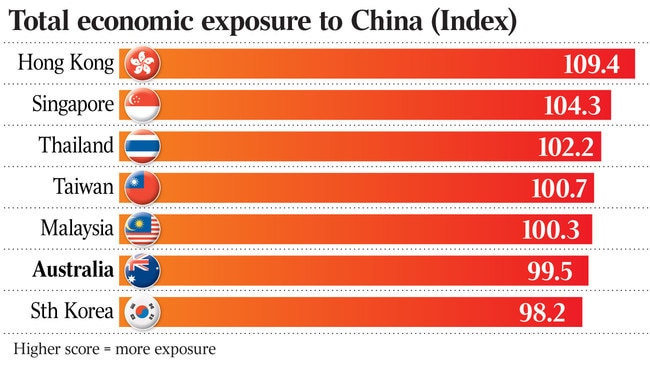

Australia was 12th in a list of 26 countries ranked by Nomura according to their vulnerability to contagion risk from 2019-nCoV, and sixth in a list of 11 countries — after Hong Kong, Singapore, Thailand, Taiwan and Malaysia — ranked according to their economic exposure to the outbreak.

Mr Subbaraman said his “tentative assumption” is that the 2019-nCoV infection rate in China would start to noticeably taper late this month, allowing the government to ease the lockdown of major cities in March, and that the infection rate outside China did not accelerate.

“Where we are more certain is on the disruptions that have already happened in China being already substantial enough to result in a sharp slowdown in its first-quarter GDP growth,” he said.

“Our base case is that the shock will be transitory, lasting for one quarter, and should be followed by a V-shaped recovery in the second quarter as pent-up demand and production are unleashed. However … the risks to our base case are skewed to the downside.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout