Digney last year signed a $332.5m deal with Norway-based shipping giant Wallenius Wilhelmsen to buy its roll-on roll-off port facilities and accompanying land in Melbourne.

The facility matched Qube’s operations in Port Kembla and Brisbane, giving it a stranglehold on the handling of Australian car imports.

Blocking the merger next week comes as ACCC chief Gina Cass-Gottlieb celebrates on Friday her third year in the job.

It also comes after the release of the ACCC’s report on supermarkets which, as expected, did not include a smoking gun but highlighted the impact of Australia’s concentrated industry structure and Australian supermarkets enjoying top-tier global profit margins.

Ironically, federal Treasurer Jim Chalmers used the report’s lack of new damning findings for his own political point scoring – by rejecting ludicrous Opposition calls for divestiture.

He said in a statement “the ACCC’s comprehensive and evidence-based 441-page report does not support a divestiture power or the claim that breaking up supermarkets will do anything to help consumers”.

The report has already spawned the dodgy discount case against Coles and Woolworths launched last year, and dooms the sector to continued scrutiny which may finally prompt action on planning laws and other state-based initiatives.

Like banks and Qantas, the big supermarkets take turns in being political footballs; a

victim of their size and central role in people’s lives.

But this report, which found little new since the last major ACCC review in 2008, points to a gap in competition policy.

Mergers must be stopped before concentration is entrenched but myriad other actions, from planning laws to labour practices and overlapping state controls, need to change to make the sector more efficient. The reality is that supermarket earnings margins have hardly moved, which is evidence of a highly concentrated sector but not price gouging.

The Cass-Gottlieb regime at the ACCC has so far seen a clear reduction in competition law cases – which should be a key focus and an expected one given her background as Australia’s top competition lawyer.

But practitioners contacted score her term so far overwhelmingly highly, delivering on her agenda and having successfully mastered the difficult brief, ranging from energy prices to airline contempt for consumers and dealing with a government better with talk than action.

The paranoia on display in the supermarket sector ahead of this week’s release of the ACCC report on the sector underlines the regulator’s credibility maintained by Cass-Gottlieb, reinforced by the outcome of the supermarket which after 12 months of intensive study did not produce and new damning findings.

It also highlights the danger for the ACCC in being used to achieve political ends.

This week the ACCC also released its draft guidelines for the new merger regime which formally comes into effect next year, and a trial starting from June.

The compulsory notification scheme has result in an increase in the ACCC’s powers, and staff numbers in the merger division have been more than doubled to 146 people to handle the influx.

But the government has failed to support the ACCC as Treasury is yet to release its draft thresholds for the new regime, which is appalling given the demands for compulsory notification of mergers above a certain size are central to the new rules.

The government has also let the ACCC down missing deadlines on other committed reforms like ex ante regulation for digital platforms via company-specific codes of conduct.

Digney lodged his application for merger approval for the vehicle deal in June last year and has attempted to beat the ACCC’s wrath with a series of behavioural undertakings which don’t appear to have shifted the dial in his favour.

The focus in competition works best when mergers are stopped to prevent industry consolidation – as is the case in the docks – because little can be done after the event.

The ACCC is still pursuing Google’s search dominance in Australia with an action now due to be launched in April, in an attempt to establish precedent under Australian law.

This is while it is still waiting on the progress of its digital platform enforcement powers based around company-specific codes of conduct designed to sidestep lengthy court battles.

The new powers are aimed at producing a more effective remedy than litigation, which runs counter to the continued pursuit of Google.

But the ACCC has to work with the laws on the books and not those promised by politicians.

The focus on mergers is just one more visible part of competition policy and micro economic reform along the lines of the 1993 Hilmer report is a more effective way to increase competition.

It also requires detailed work from the politicians beyond ACCC case-study references and working with state governments.

Chalmers has the steps in place for meaningful reform with a slew of Productivity Commission references, and following last year’s state agreement the next step will come after June 30 when the states are due to hand in their individual agenda focuses.

This comes long after the impending federal election.

Keeping up pressure on digital sector

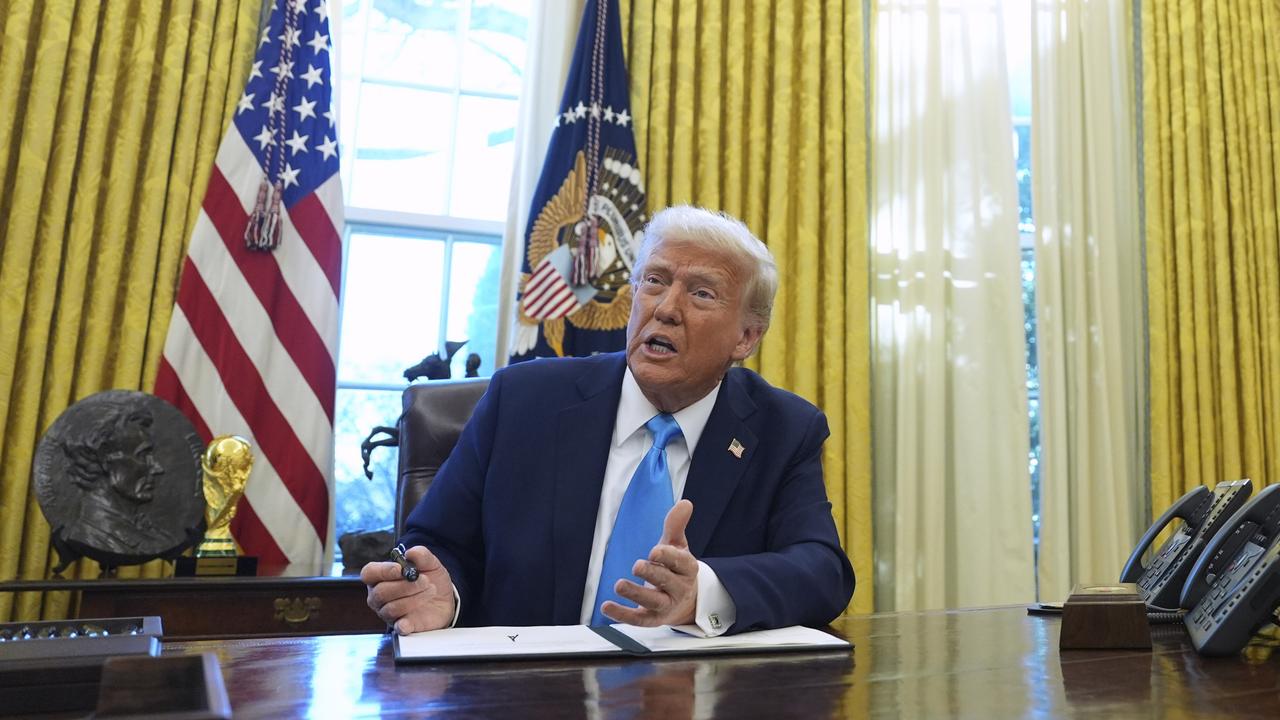

Former Fox News counsel, prominent media and technology lawyer, and Dublin native Gail Slater is the new antitrust head of the US Justice Department, replacing Johnathan Kantor.

While much was made of Kantor and FTC boss Lina Khan’s departures following President Trump’s election, the appointment of the highly regarded Slater to the top antitrust post at the DOJ is cited by some as evidence the campaign against digital platforms will be maintained.

Slater who worked for Trump in his first administration, has also worked with Vice President JD Vance’s staff when he was in the Senate.

The US has won landmark cases against Google when its search powers were deemed a monopoly and the US Federal Court is seeking divestiture of its Chrome browser.

The budget few really want

Geopolitical turmoil is one reason why the business community is not exactly on tenterhooks ahead of next week’s federal budget.

The business perception is this is a budget the government didn’t want to hand down and its measures, mostly already announced, will be overshadowed by the coming federal election in which no one is expecting to see the Albanese government returned with an increased majority.

There is obvious interest in the macro numbers, including debt and growth forecasts, and what impact they have on monetary policy.

Minority governments hold little fear for business unless the majority is a combined Greens-ALP coalition which would be treated as a doomsday scenario by business leaders.

Big business leaders contacted this week noted that Opposition leader Peter Dutton appears to have made little effort to sell himself to them – appearing in few if any of the usual regular lunches organised by law firms and others showcasing political leaders.

This says something about his focus.

Big-picture reforms like tax and deregulation are not expected to feature in the budget.

There is a view in business that if you could lock the politicians in a room bickering, that would leave it alone to do its work. But the less cyclical want less politics and more decisive policy.

This week’s jobs numbers show the government is doing the heavy lifting in terms of new jobs, which is not the desired outcome.

Qube chief Paul Digney will have to take the ACCC to court to get his $332.5m vehicle port facility merger off the ground as the regulator is poised to next week reject the deal.