Woolworths staff underpayment bill nears $600m as Fairwork Ombudsman launches fresh investigation

The major retailer has slashed its dividend and promised to work hard to fight inflation, while also revealing its total underpaid wages bill is almost $600m.

Woolworths faces a growing salary underpayments scandal – the shortfall reaching almost $600m, making it the largest corporate missing wages case in Australia.

Unveiling its interim results, which carried the bruises of the protracted Covid-19 pandemic, the nation’s biggest retailer revealed the discovery and booking of $144m relating to new payment shortfalls of hourly paid retail staff.

Included in that bill was another $21m relating to underpayments picked up since January, forcing another apology from chief executive Brad Banducci and triggering a new investigation by the Fair Work Ombudsman.

“We understand that any cent we haven’t paid a team member of what they deserve is just wrong and we apologise, but essentially we found this big issue … well away from salary underpayments and it was not an insignificant issue,” Mr Banducci told The Australian on Wednesday.

He said Woolworths had spent $20m to create teams and processes to investigate its wages underpayments problem. He said he was becoming frustrated with the ongoing missing wages saga.

“And that is in our cost structure as it should be. So actually I’m not proud about it. I’m frustrated by it. But I think we are doing the right thing and that’s what you should do,” he said.

It was in late 2019 that Woolworths shocked the market when it disclosed it believed it had underpaid 5700 of its staff by as much as $300m – a record at the time – with Fair Work launching an investigation and the company repaying staff with interest.

The scandal cost Mr Banducci his $2.6m bonus and Woolworths chairman Gordon Cairns a pay cut to his director fees.

Within a year that figure had blown out beyond $400m to $427m, setting a record for missing corporate wages, and now that collective underpaid wages, from salaried staff to managers and those on various rosters, has mushroomed to $571m.

Mr Banducci said Woolworths “went looking” for the possibility of further wages that were unpaid and that the retailer “wasn’t told do it” – and it discovered the new cohort of missing wages accounted for 0.8 per cent of what it pays its 150,000 staff in any one year.

“We figured as the biggest employer in the country we had to set the right benchmark,” he said.

He also welcomed the new investigation by the ombudsman.

In outlining the company’s results for the six months to December 31, Mr Banducci warned it was “inevitable that some prices will increase” but that Woolworths would work to deliver affordable groceries.

Mr Banducci said shelf prices had already increased by 2-3 per cent this year as cost pressures from suppliers and across the supply chain hit the supermarket industry.

The costs of keeping its stores and distribution centres within pandemic guidelines, which includes incentives and discounts to staff, exploded in the half, rising to $239m in the first half of the 2022 fiscal year against $55m in the previous corresponding period.

Its Big W chain, which Mr Banducci had spent years turning around to finally be profitable, was deeply bruised by trading restrictions, with its earnings collapsing 81.2 per cent to be barely profitable in the first half.

Woolworths on Wednesday posted a net profit of $7.06bn, up 522 per cent and reflecting the multibillion-dollar gain from the spin-off of its drinks and pubs business Endeavour.

Excluding the Endeavour demerger, profit after tax from continuing operations fell 6.5 per cent to $795m. Earnings before interest and tax on continuing operations fell 11 per cent to $1.382bn.

Woolworths said revenue for the period rose 8 per cent to $31.894bn. Across the key divisions of its retail businesses, its Australian supermarkets earnings fell 7.6 per cent to $1.217bn, earnings at its New Zealand supermarkets rose 5.9 per cent to $191m and Big W earnings slumped 81.2 per cent to $25m.

The retreat in underlying profits and the loss of earnings that would have flowed from Endeavour saw Woolworths slash its interim dividend by 26.4 per cent to 39c a share, payable in April.

The dividend compares to a dividend of 53c a share in the prior year. However, based on Woolworths’ first-half payout ratio, 13c of the prior-year dividend relates to the demerger. Woolworths shareholders who received Endeavour shares in the demerger last year will be handed a 12.5c interim dividend from Endeavour declared this week.

At its flagship supermarkets arm, total Australian food sales for the half increased 3.4 per cent to $23.8bn, with Woolworths retail sales increasing 3.2 per cent. Comparable sales for the half increased 2.3 per cent despite cycling 2021 first-half comparable sales growth of 9.5 per cent as the pandemic triggered panic buying, with two-year average comparable sales growth of 5.9 per cent.

Woolworths shares closed 1.4 per cent lower at $35.68.

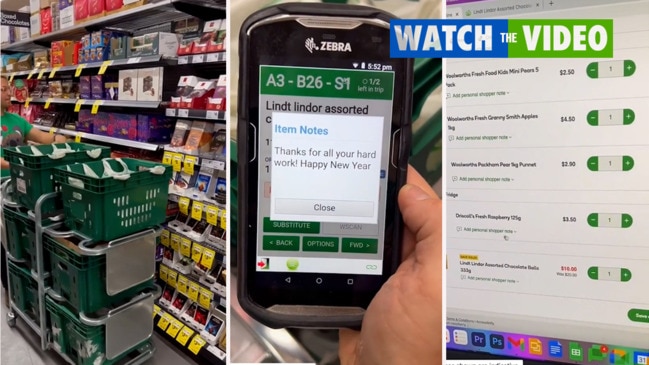

Mr Banducci said Woolworths retail sales benefited from higher in-home consumption driven by extended lockdowns in NSW and Victoria and the rollout of additional e-commerce capacity.

Mr Banducci also said the Omicron outbreak had boosted food sales in early January.