‘Won’t let it distract us’: Optus boss rallies staff as Brookfield circles

Optus’s interim CEO Michael Venter has dismissed potential takeover talks with Brookfield as ‘media speculation’, while its owner Singtel has left the door open for a deal.

Optus’s interim chief executive, Michael Venter, has dismissed talk about a potential takeover from Brookfield, urging the telco’s staff not to let it “distract” them as it seeks to rebuild customer trust after a massive cyber attack and national network outage.

Its parent company Singtel has been secretly considering options for a selldown of its Australian subsidiary for months. It is understood discussions with Canadian private equity giant Brookfield have entered an advanced stage on a potential deal that could value Optus at $16bn.

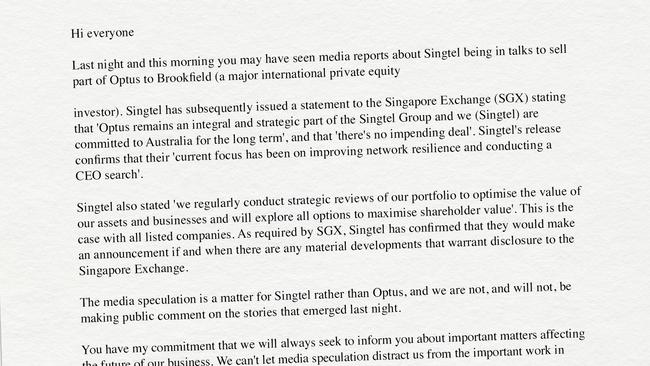

But Mr Venter told staff that there was “no impending deal”, and dismissed the talks as “media speculation”.

“The media speculation is a matter for Singtel rather than Optus, and we are not, and will not, be making public comment on the stories that emerged last night,” Mr Venter said in the internal note seen by The Australian.

“You have my commitment that we will always seek to inform you about important matters affecting the future of our business. We can’t let media speculation distract us from the important work in front of us as we continue our work to rebuild customer trust.”

But Mr Venter’s note left out a second clause from Singtel’s statement. Singtel said there was no deal to “offload Optus for the said sum”, leaving the door open to a potential selldown.

It is understood Brookfield is looking to acquire a significant stake in Optus rather than its entire operations.

“We regularly conduct strategic reviews of our portfolio to optimise the value of our assets and businesses and will explore all options to maximise shareholder value,” Singtel said.

Mr Venter said in his note to staff that “this is the case with all listed companies”.

“As required by SGX (Singapore Exchange), Singtel has confirmed that they would make an announcement if and when there are any material developments that warrant disclosure to the Singapore Exchange,” he told staff members.

Brookfield has been approached for comment.

Singtel bought Optus in 2001 for $17.5m – a fraction of the total cash it has injected into its Australian network and Optus’s net assets, which totals about $10bn, including debt.

The Australian reported in the weeks after Optus’s national outage – which led to tens of thousands of customers leaving for rivals Telstra and TPG – in November last year that Singtel was exploring sale options.

Singtel revealed last month that the network meltdown had cost Optus $61.2m. It dragged down Singtel’s overall profit in the three months to the end of December by 13 per cent to $S465m ($527.5m).

The network meltdown – which cut off more than 10 million people from phone and internet services – was Optus’s second reputational crisis in 13 months, after 2022’s cyber attack.

As well as wiping out small businesses’ profits, almost 2700 customers could not dial triple-0 for emergency services during the day-long outage.

It ultimately cost chief executive Kelly Bayer Rosmarin her job. The company is yet to find a permanent replacement, and has since sacked almost 200 staff, with managing director of networks Lambo Kanagaratnam following Ms Bayer Rosmarin out the door.

Optus has also shut down its O-Team, a residential smart devices and EV charger installation business, which was one of its newest ventures.

Singtel has never run a formal sales process, but in the past 12 months it is understood to have let the likes of Blackstone, Brookfield and the nation’s biggest superannuation firms know that it is open to offers for all or parts of its Australian business, and has considered an initial public offering.

Optus could be attractive to private equity because of the potential to monetise its infrastructure assets. Bigger rival Telstra sold a 49 per cent stake in its mobile towers in 2021 for $2.8bn, reflecting a huge earnings multiple of 28 times.

In a statement to the Singapore Exchange, Singtel said Optus remained an “integral and strategic part of the Singtel Group” and the “current focus has been on improving network resilience and conducting a CEO search”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout