They are each set to post super-profits, and in the midst of an inflation breakout, with cost of living top of mind, they will certainly attract accusations of gouging. But more than ever chief executives need to refine the message about the purpose of profits.

Profit outrage has always been a fluid concept. It comes around every six months for listed companies, and for their CEOs it’s a balancing act.

Large and small investors on the receiving end of a dividend cheque complain profits are never enough and expenses or capex are always too high.

Customers and workers on the other hand are quick to call out big profits or poor standards. But many are reluctant to define what an acceptable level of profit is. CEOs need to straddle the ideas that earnings are being maximised but not at the expense of customers or other stakeholders.

Booming profits have stirred the ACTU into action. It recently announced an inquiry into price gouging and unfair practices, to be chaired by former Australian Competition & Consumer Commission boss Allan Fels.

But as former deputy Reserve Bank governor Stephen Grenville recently wrote in The Australian, the inquiry will be helpful to first define what “gouging” is and the forces that drive end prices.

Is fuel refiner Ampol marking to market the holdings of oil sitting on its books really a windfall profit? Does the refiner genuinely have pricing power in a global energy market?

Is an insurer like Suncorp taking customers for a ride by passing on surging global reinsurance costs when earnings are inflated following a $700m turnaround on its bond portfolio? You can set your watch on Transurban’s six-monthly toll road hikes, but they are under the terms of a concession contract with respective state governments.

Ordinary profits

CBA’s bumper $10.2bn full-year profit, handed down this month, is indeed a very big number. But step back and it represents just 0.8 per cent return on a lending book that is valued at $1.25 trillion. Among global returns, this is in the middle. If it is so ordinary what then is the right profit number for CBA?

CBA chief executive Matt Comyn believes it shouldn’t be a choice between profitability or doing a good job for customers.

“Every business has to do both. If you’re not doing a good job for your customers or you’re not winning new customers you’re not able to grow. You can’t possibly generate sustainable returns,” Comyn says.

And if banks that are generating sub-par profits or even losses, why would investors – or even depositors – want to put their money in?

This would lead to “very bad lending outcomes or the inability to be able to support the broader economy”, Comyn says.

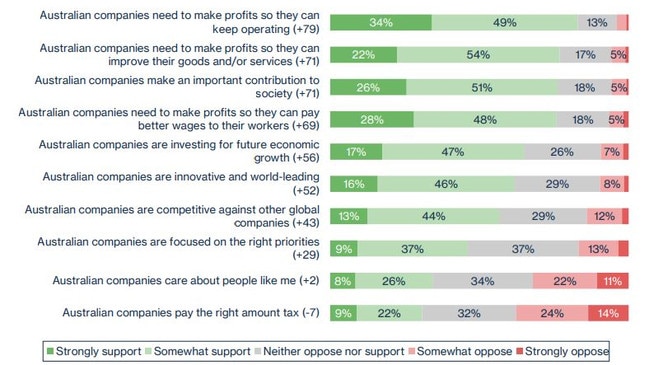

Lynton Crosby’s advisory CT Group has put the notion of profit outrage in a different light, but there are lessons for companies in the message behind earnings numbers. A recent deep dive on a range of issues found that Australians overwhelmingly (83 per cent) agreed that companies need to make profits to keep operating.

Likewise there was strong support (76 per cent) for the notion that companies need to make profit to improve their goods and services. Those surveyed also endorsed companies making profits (76 per cent) so pay and conditions for workers can improve. The idea that profits were invested back into the economy was also supported (64 per cent).

However, Australian executives need to take note. Support fell into the minority (43 per cent) over the statement that Australian companies are focused on the right priorities. Even fewer supported the suggestion that companies care about ordinary people (34 per cent). The least support was for the statement Australian companies pay the right amount of tax (31 per cent).

This should set alarm bells ringing for business, given the findings make it politically easier to impose a super-profits tax or bank levy, like the windfall bank taxes recently introduced by Italy and the Morrison government in 2017. Questions accompanying the CT Group survey with a more political edge provide stronger context: right now economic concerns dominate voters’ priorities. Cost of living is the top concern (53 per cent) by a country mile. This is followed by fears of recession and inflation at 19 per cent. Housing supply concerns came in at 18 per cent, and climate change at 16 per cent. Interestingly, mortgage repayments and interest cost concerns came in at just 6 per cent – although some of this may have been captured by the cost of living.

CT Group has interpreted the findings to show that care is needed in the message around profits. There is an understanding of the role of profit but executives need to do a better job of linking profit to its utility or a call to action on how it will be used.

Qantas focus

There’s many moving parts to profit numbers and this is especially true for a complex business with multiple divisions. Woolworths got a drubbing when it released interim results last February. Headline earnings across its supermarket business jumped 18.4 per cent to a little over $1.4bn. However, look a little deeper and claims of inflationary price gouging didn’t stand up. Woolworths’ profit was flattered by the previous period of the December 2021 half, when earnings were lower than normal because hundreds of millions of dollars in extra Covid costs had been baked in. Strip that out and Woolworths’ supermarket earnings growth of 4.3 per cent was underwhelming as well as sub-inflation. Woolworths, which employs 197,000 globally, will deliver its full-year results on Wednesday and CEO Brad Banducci faces a similar challenge to explain the numbers behind the numbers.

Qantas too will be the biggest focus in the coming days. The airline that was weeks away from bankruptcy in the middle of the pandemic and slashed thousands of jobs is set to deliver a record profit of $1.6bn on Thursday, amid accusations of customers getting a raw deal. This will be CEO Alan Joyce’s final set of results.

Qantas is yet to pay any dividends following a combined $2.7bn in losses over the past two years (although there has been share buybacks) and the airline faces heavy investment spending for a $7.8bn fleet renewal program, a move that is expected to create thousands of new specialist jobs.

Airlines globally have responded to surging demand for travel with higher prices. This pushed ticket costs up well above inflation and Qantas’s efforts in this regard are unexceptional among its global peers. The bigger Singapore Airlines is running profits at an annualised rate of more than $3bn. British Airways owner International Airlines Group is running at an annualised rate of over $4bn. Qantas can’t afford to get left behind.

johnstone@theaustralian.com.au

Commonwealth Bank’s billions copped it, as did energy company AGL. Coming up this week are BHP, Coles, Insurance Australia Group, Qantas and Woolworths.