That might go against the grain of the tidal shift to everything moving online, but Richard Murray says the best retailers need absolutely to get both worlds right.

Murray, who now heads up the retailing arm of Solomon Lew’s Premier Investments, says it is clear the retailers who had been investing in their online business before the pandemic hit in early 2020 were the ones to benefit from multiple Covid-lockdowns.

Australian retailing was given a fortuitous wake-up call to get match fit for online from early 2017 when Amazon outlined plans to build out a local presence and develop a distribution network. The threat then of the global retail giant cutting a swath through the Australian market was enough for existing players from the boardroom down to rate online as a serious channel and substantially boost allocation of tech spending. This got its first major test through Covid and now retailers are finding themselves years ahead of their online targets.

The trick is to capitalise on this growth, Murray says.

“There’s nothing like a pandemic to drive a change in behaviour,” says Murray who until August headed up electrical goods juggernaut JB Hi-Fi. “Before (Covid lockdowns) In my lifetime I’ve never had a retail store forced to close. I turned up to a new job and 600 were closed”.

Despite the disruption, customers “seamlessly” adjusted their shopping behaviour between the online and store channels.

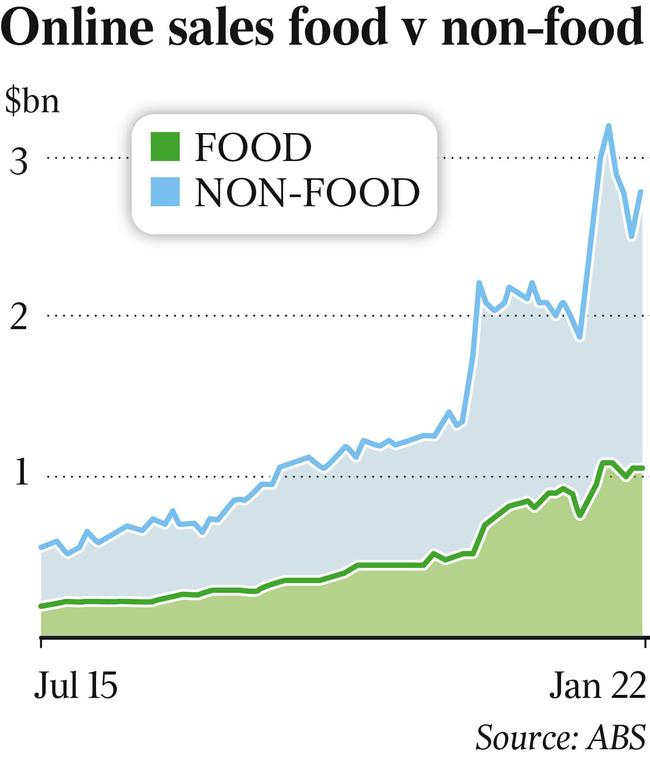

Latest ABS figures show the proportion of online sales for non-food goods was 17.5 per cent of all retail spending in January. In the height of the lockdowns across the two biggest cities in September last year, a record 25 cents in every dollar being spent on non-food retailing in Australia was over the internet.

At Premier, online sales of $195m in the six months to end-January were up 27 per cent on the same period a year earlier and have more-than-doubled over two years. In the January half, online sales represented more than 25 per cent of all sales for Premier across its flagship brands Peter Alexander, Smiggle, Just Jeans and Portmans.

For Murray, online sales are now significantly more profitable than those made in store.

But non-sales benefits are significant including the wealth of basic data and real-time feedback about consumer behaviour including how and when they shop that is now giving retailers the edge. In other words, retailers are turning the tables by using the same tools that gave Amazon its advantage.

“It’s hard to follow a customer in a store and get a lot of data about how customers are shopping. But online customers have taught us a lot and we will continue to lean into that investment,” Murray says.

And ironically the rise online has also tilted the power balance slightly back toward retailers in the long-running battle with shopping mall landlords over rents. Now it is easier for retailers to walk away from unprofitable or marginal stores knowing the sales growth will be made up from online. This has changed the conversation with landlords.

‘Committed’

Even so, Murray says he is absolutely committed to bricks and mortar stores. A presence in shopping malls gives credibility to online business.

“I think one thing sometimes people forget is you can have a great online business because you’ve got really great retail stores”.

“It is very different building an online business without the strength and credibility that your bricks and mortar stores have delivered,” Murray says.

It underscores the challenges that pure digital retailers face when they attempt to pivot to a store network.

Very few digital retailers have made the conversion to so-called omnichannel even as the biggest has tried.

Earlier this month, the world’s biggest online retailer Amazon declared defeat on a high street presence saying after six years it plans to close all 68 of its bricks-and mortar bookstores and pop-up shops in the US and UK. Amazon has the biggest balance sheet when it comes to retailing and has experimented with small convenience stores without cashless and stores that sell goods with high online customer ratings.

Amazon will continue to focus its physical presence in the up-market US grocery chain Whole Foods it acquired in 2017.

Investment bank JPMorgan has taken a deep dive into online retail in Australia and found the rise of online through the Covid pandemic created opportunities. Given store closures most traditional retailers generated over 10 per cent of total sales from online while several retailers generated more than 20 per cent of sales from digital channels.

And interestingly it was the traditional retailers that have pivoted online that were the best place to improve profitability, JPMorgan’s Bryan Raymond said.

While pure play retailers Temple and Webster, Kogan and Adore Beauty generated the strongest sales growth versus pre-Covid, their operating leverage – that is ability to turn sales into profit – has been modest, Raymond says.

This points to pure online retailers having a high-variable cost base. That is, costs rise as the business grows. It also suggests a higher cost in acquiring customers and shipping to them.

JP Morgan nominates Premier Investments, JB Hi-Fi and Harvey Norman as the best in navigating the sales shift from stores to online. These three managed to improve their profit margins while doing so.

Woolworths, Coles and Wesfarmers have some of the biggest headwinds for online, they still need to “accelerate investment in automation” to become more efficient and drive better returns from online.

The traditional retailers with some of the biggest online penetration include Officeworks, Adairs and The Shaver Shop all with digital representing more than 40 per cent of sales during the December half. Of the established players Wesfarmers’-backed Bunnings had 4 per cent online penetration.

Scale to win

Murray says the key for online profitability is scale at Premier there is one online team running 17 websites globally. It is all built around a single platform. If each brand was to have its own team this would require hundreds of more staffers.

For Premier much of the groundwork for the work in online happened in 2013 when Premier started building a centralised distribution centre outside Melbourne.

At the time Premier’s chairman Solomon Lew told investors the $30m hi-tech warehouse was aimed at supporting the growth in the retailer’s online business. It was important to own and control distribution and logistics where “multichannel sales are vital to our success”.

Today the investment is still yielding benefits. The warehouse, which was designed by Goodman Group, allowed Premier to quickly pivot to online in response to the massive customer demand during lockdown. In 2013 Lew told investors Premier had an aspirational target having 10 per cent of all sales through online channels.

Fast forward to today and Lew, who has more than six decades of retailing experience, says customers need to be looked after wherever they are.

“We’re a retailer that wants to have sales at the retail store and sales online. We’re in the service business, so we need to service the consumer,” Lew says.

johnstone@theaustralian.com.au

The Australian’s E-Commerce Summit 2022 will be held online on April 7. The summit explore the continued rise of e-commerce and how Covid has changed the landscape for retailers. Information can be found here.

One of the surprising lessons for retail even after Covid rewrote all the rules is that a store network still counts.