Management to pay for Wesfarmers’ Bunnings UK failure, says CEO

Wesfarmers CEO Rob Scott says management will pay a financial price for the aborted and costly push into UK hardware.

Wesfarmers chief executive Rob Scott has admitted that management will pay the price for the disastrous decision to buy the troubled Homebase hardware chain in the UK, which has cost shareholders more than $1.5 billion in losses, but stopped short of saying if the Wesfarmers board would also pay a financial penalty.

He was speaking after Wesfarmers announced an end to its disastrous two-year experiment to roll out its Bunnings hardware stores in Britain and Ireland, with the Perth-based conglomerate announcing it will divest its Homebase UK business to private equity firm Hilco Capital.

Wesfarmers (WES) will sell the UK hardware chain for a pittance compared to the $705 million it paid for it in 2016, on top of the $1 billion in writedowns it also took on the business this year.

The Perth-based conglomerate said it will record a loss on disposal of the business of £200 million to £230m ($353m-$406m) in the group’s full year 2018 results, subject to review by Ernst & Young.

Mr Scott said today he expected “significant remuneration implications’’ when it came to pay and bonuses for Wesfarmers management linked to the failed Homebase investment.

“Clearly there have been negative financial implications from this, and from a management point of view we are all shareholders and will feel the pain of that and there will be remuneration implications from the impairments and from the losses and we will ultimately disclose that to the market in due course,’’ Mr Scott told analysts this morning.

Mr Scott was repeatedly pushed by analysts to detail the financial penalties meted out to management and the Wesfarmers board over the Homebase debacle.

“From a management and board point of view we fully understand the buck stops with us, and there needs to be that accountability,’’ Mr Scott said.

But he stopped short of detailing any loss of remuneration or bonuses that could be felt by the directors of Wesfarmers who made the decision to buy Homebase in the first place in 2016.

“All I can say at the moment is that I fully expect, and it is not ultimately my call, we go through a remuneration committee and board processes and so forth, but it is my expectation there will be significant remuneration implications as a result of the impairments.

“You just can’t look through impairments and pretend they didn’t happen. Now it’s premature to articulate precisely how that will play out but at the appropriate time when we disclose remuneration reports and so forth I fully expect we will see how those implications play out.’’

However, the Wesfarmers CEO who struck the deal to buy Homebase, Richard Goyder, is no longer at Wesfarmers, and nor are the CFO at the time and later, the boss of Bunnings, John Gillam.

Under the terms of the agreement announced this morning, Wesfarmers will sell all the Homebase assets, including the Homebase brand, its store network, freehold property, leases and inventory, for a nominal amount.

However, Wesfarmers will reserve some possible upside for the deal, with it to be entitled to a 20 per cent stake in any equity distributions from the business in the future.

This part of the deal won’t be limited by time, meaning Wesfarmers could get some money back and participate in any profitable divestment of the business in the long-term by Hilco.

The failed UK hardware experiment is reminiscent of the experience of archrival Woolworths, which also blew up on its idea to roll out Masters hardware stores in Australia. That failure cost Woolworths billions of dollars in losses and the chain was ultimately shut down completely.

Ironically the day Woolworths announced it was shuttering Masters was also the same day Wesfarmers unveiled its grand plan to but the Homebase hardware chain in the UK and kick off its offshore expansion of Bunnings.

Wesfarmers unveiled its UK and Ireland ambitions in 2016 with a decision to buy the struggling Homebase retail chain for $705 million and transform its 200-plus strong network of stores into Bunnings warehouses.

Wesfarmers planned to invest more than $1 billion to transform the business and give UK shoppers a “Bunnings” experience, but the strategy floundered almost immediately with British shoppers rejecting the Bunnings way of doing things and its warehouse-style shopping model.

The chain’s problems later forced Bunnings and Wesfarmers to write down the value of the business by more than $1 billion, as losses started to rack up.

Under pressure from analysts and the investment community, Wesfarmers launched a review of Homebase and Bunnings in the UK earlier this year. It has now decided to sell off the entire chain and walk away from the offshore experiment.

Mr Scott, who inherited the Homebase mess when he was named CEO last year, said this morning that while the company still believed Homebase would return to profitability over time, it needed further capital investment to support that turnaround.

“The materiality of the opportunity and risks associated with the turnaround are not considered to justify the additional capital and management attention required from Bunnings and Wesfarmers,’’ he said today.

Mr Scott said the Homebase acquisition was “disappointing” with the problems arising from poor execution post-acquisition being compounded by a deterioration in the macro environment and retail sector in the UK.

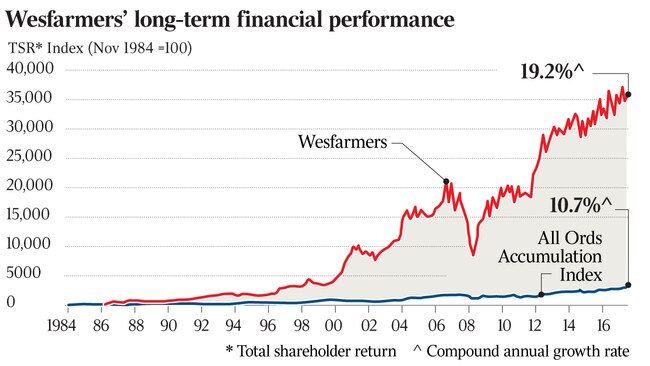

“While it is important that we learn from this experience, this should not discourage our team from being bold and diligent in pursuing opportunities to create shareholder value.’’

The UK experiment also had also suffered from an exit of key executives, including Bunnings boss John Gillam, who left shortly after the UK deal was sealed.

Then, Bunnings UK boss Peter Davis left this year after initially taking a three-month leave of absence before Christmas. Bunnings UK finance director Rodney Boys also opted to leave.

Wesfarmers recently said its Bunnings UK operation had a pre-tax loss of £97m ($172m) for the six months to the end of December, compared to a loss of £28m in the prior corresponding period. Revenue in Britain and Ireland fell 15.5 per cent to £517m.

The 24 Bunnings pilot stores in the UK will convert to the Homebase brand promptly following completion of the deal.

The divestment and sale to Hilco should be completed by June 30.

Hilco Capital was founded in 2000 in partnership with Hilco Global in the US. Located in the UK, it has offices in Europe, Canada, and Australia, where it trades as Re. Capital, and currently manages about 20 investments, with a combined turnover in excess of £1 billion.

It has been involved in a number of successful retail restructuring projects in the UK and Europe like HMV and the UK arm of Staples.

Countdown to a UK retreat

* January 2016 — Wesfarmers’s Bunnings buys Homebase, a hardware retailer that operates 250 stores in the UK and Ireland, in a deal worth around $705 million;

* January 2016 — At the time of the acquisition, then managing director Richard Goyder said: “The opportunity to enter this attractive market through the acquisition of Homebase has been comprehensively researched and carefully considered by Wesfarmers and Bunnings”;

* August 2017 — Homebase reports an $89 million loss in its first full financial year;

* October 2017 — Homebase suffers a 13.8 per cent fall in sales to $457 million during the first quarter of the 2018 financial year;

* February 2018 — Homebase is hit with $1 billion in impairments and writedowns;

* February 2018 — Wesfarmers launches a review of Homebase projecting that between 20 and 40 of its worst performing stores could close;

* April 2018 — Bunnings blames severe weather for significantly hurting trade in its UK stores in the March quarter, the majority of which still trade as Homebase;

* May 2018 — Wesfarmers announces it will sell the Homebase chain and record a $353 million to $406 million loss.

With AAP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout