Wesfarmers takes $1.3bn hit as Bunnings UK bleeds

Wesfarmers shares fell 5pc after it announced a $1.3 billion writedown and a review of its Bunning UK operation.

Wesfarmers boss Rob Scott is adamant he will not fall into the same trap as Woolworths with its disastrous Masters hardware experiment that limped along for years racking up billions in losses, with a review of the struggling Bunnings operation in Britain to decide its fate quickly.

All options remain viable, including dumping the British unit by selling it or closing it down, although Mr Scott hopes it could be make profitable.

Announcing $1.3 billion in writedowns yesterday flowing from Bunnings in Britain and a still problematic retail chain Target, Mr Scott characterised the Bunnings impairments as “terrible” and “confronting” news, but signalled he wouldn’t allow it to drag on for years.

“I appreciate that what we have disclosed today is terrible news, terrible news for shareholders, and we feel the pain of that as shareholders as well, but what is most important as the new CEO and new CFO is what do we do from today onwards to address this issue.

“We are not just going to let this roll out for years and years and years,” Mr Scott told The Australian. “We need to provide certainty and clarity over it.”

Only four months in the job and inheriting a growing operational mess in Britain from former chief executive Richard Goyder who led the acquisition of Homebase in 2016, Mr Scott said a complete review of the Bunnings British arm would seek to patch up its faults to make it profitable, although a complete sale of the offshore business could not be ruled out.

“It is not our preferred option, but all options are open. And we will go through this review in a very detailed way, very strong focus on improving performance and reducing the cash losses.”

However, an eventual sale or closing down of Bunnings in Britain would prove incredibly costly with Mr Scott revealing it was sitting on lease liabilities of at least $1bn.

The cost for now to Wesfarmers was brought into focus for investors yesterday when the company said a worsening of sales over the northern winter would trigger non-cash impairments of £454 million ($795m) before tax with £444m to be recorded against goodwill.

There would also be stock writedowns of £37m relating to excess, unsuitable and display stock, underlining the fact that some of Bunnings product range for Britain had proved unappealing to shoppers. There was also a writedown of deferred tax assets of £53m, reflecting a more conservative outlook for the business.

Bunnings UK was now heading for an underlying loss before interest and tax of £97m.

Peter J. Davis, managing director of the British and Ireland Bunnings unit, who at Christmas took extended leave, will be retiring. Damian McGloughlin, with more than 30 years’ experience in the British home-improvement market, will take over leadership of the unit.

Adding further pain, Target was still dragging its heels after years of restructures, new strategies and a revolving door of chief executives and would incur a non-cash impairment of $306m.

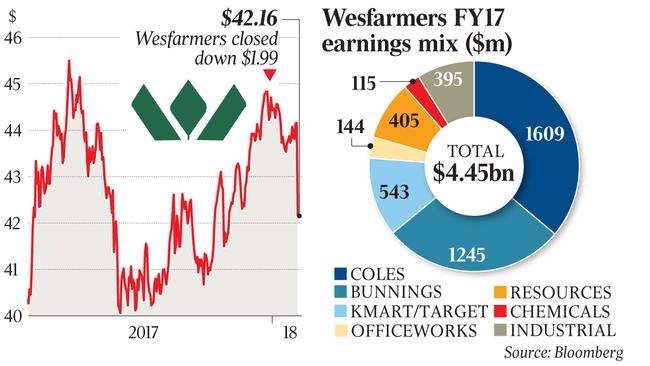

Shares in Wesfarmers slumped 5 per cent on the dour earnings outlook for Bunnings UK and the impairments, closing down $1.99 at $42.16. It was a bruising day for shareholders as more than $2.5bn was wiped off Wesfarmers’ market value.

Mr Scott was unable to nominate when he believed its loss-making British unit would emerge profitable, and admitted to a string of “self-induced” errors, including poor range in the kitchen and bathroom categories and shoppers not warming to a new pricing model.

“What we are mindful of is that a lot of the issues we are dealing with today have been, to be frank, self-induced,’’ Mr Scott said.

“We are investors and we think like investors and the reason why we are announcing what we are announcing today is we feel it is important that we take decisive action to deal with an area of significant underperformance and we are very focused on reducing the losses and taking the actions necessary.”

Detailing the operational issues in Britain, Mr Scott said the kitchen and bath categories remained “problematic” and that it took longer to come up with their own Bunnings model for the kitchen offer and get that into the stores. Upheaval in the kitchen category and a downturn in sales had spilled into adjacent categories like flooring, plumbing and tiling.

Argo Investments chief executive Jason Beddow said he was surprised and disappointed with the souring performance.

“It is probably a little bit surprising, it’s disappointing and probably places a question mark over their offshore expansion strategy and probably means it will cost more and take longer even if they get it right.

“So what kind of returns do they now expect out of the Bunnings UK business if it all goes well from here? Could it be Wesfarmers’ (own) Masters — let’s hope not.”

Masters made a bold bid to create a new force in hardware in Australia, but was allowed to drag on for more than five years racking up more than $3bn in losses and impairments before it was put out of its misery by Woolworths and closed down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout