Wesfarmers selling down Coles stake

Perth-based conglomerate Wesfarmers is taking advantage of record highs in the Coles share price to sell off its $1.1bn stake.

Perth-based conglomerate Wesfarmers is taking advantage of record highs in the Coles share price and generally buoyant conditions in equity markets to sell off $1.1bn of its stake in Coles, representing one third of its total holding, marking the next step in its demerger and eventual sell down of its holding in the supermarket group.

After the market closed on Tuesday, and following the release of Coles’ first half results, Wesfarmers announced it had entered into an underwriting agreement with two lead managers to sell 4.9 per cent of the issued capital of Coles. It is using the services of UBS and Macquarie Bank for the sale.

Wesfarmers, whose directors are currently in a board meeting before the release of its half-year results on Wednesday, is looking for prices between $16.08 and $16.45 as it aims to sell 65.4m shares in Coles to investors.

Following the sale process, Wesfarmers will retain a minority interest of 10.1 per cent in Coles and its right to nominate a director on the Coles board, maintaining the ongoing relationship between the two companies since the demerger of Coles from Wesfarmers in November 2018.

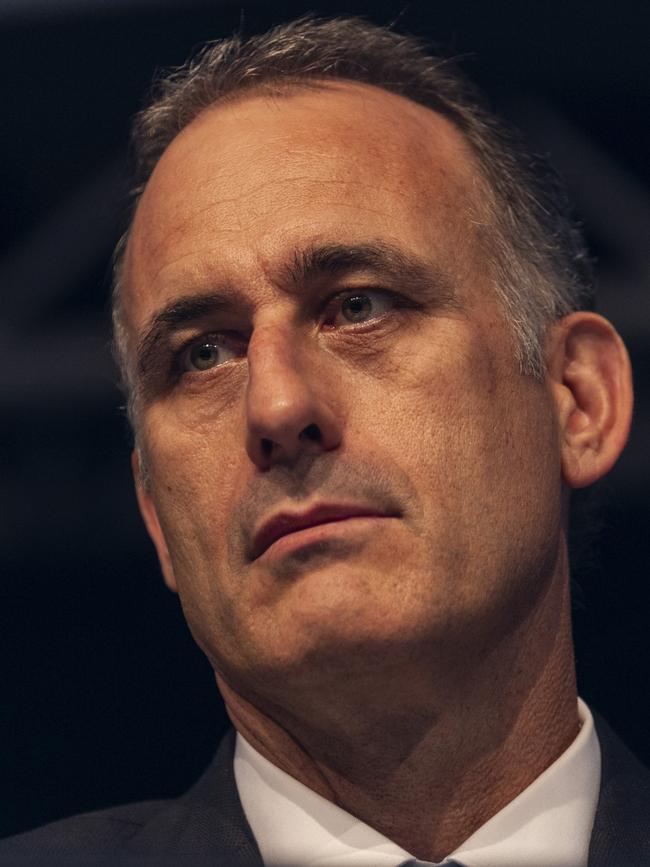

The sell down comes as Wesfarmers managing director Rob Scott is continuing to reshape Wesfarmers, which has seen him in the past few years generate billions of dollars in revenue from the sale of its Bengalla coal mine, the sale of Kmary Tyre and Auto as well as the sale of Quadrant Energy.

Wesfarmers demerged Coles supermarkets in 2018 and the selldown has been widely expected in recent days.

Under the relationship deed agreed with Coles at the time of the demerger, Wesfarmers has the right to nominate a director to the Coles board while it retains an interest in Coles of at least 10 per cent.

It comes as Coles shares trade near all-time highs and have risen almost 50 per cent in the last year.

Mr Scott said the partial sale of the Coles shareholding would crystallise a strong return for shareholders while enabling continued strategic alignment and collaboration between the two companies in relation to mutually beneficial growth initiatives.

“We believe this level of divestment is in the best interests of our shareholders and consistent with our objectives at the time of the demerger, which included demonstrating continued confidence in Coles’ future as a stand-alone listed company,” Mr Scott said.

“We have been pleased with the performance of Coles as an independently listed entity and believe it is an appropriate time to realise value for our shareholders while retaining a meaningful interest and ongoing connection with Coles, including representation on its board and through our flybuys joint venture.”

Bids are to close at 7pm on Tuesday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout